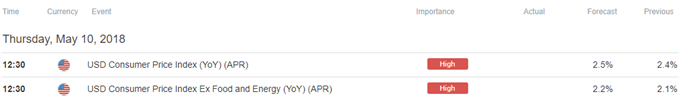

Trading the News: U.S. Consumer Price Index (CPI)

- U.S. Consumer Price Index (CPI) to Pick Up for Third Straight Month in April. Core Rate to Increase to Annualized 2.2% from 2.1%.

- EUR/USD Preserves Bearish Sequence, Relative Strength Index (RSI) Sits in Oversold Territory.

Another pick up in the headline and core U.S. Consumer Price Index (CPI) may fuel the recent decline in EUR/USD as it puts pressure on the Federal Open Market Committee (FOMC) to adopt a more aggressive approach in normalizing monetary policy.

Signs of above-target price growth may push Chairman Jerome Powell and Co. to adjust the dot-plotat the next interest rate decision on June 13 as ‘the Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate,’ and the committee may show a greater willingness to extend the hiking-cycle as the central bank largely achieves its dual mandate.

However, a series of below-forecast prints may generate a rebound in the euro-dollar rate as it saps bets for four rate-hikes in 2018, and Fed officials may continue to project a terminal benchmark interest rate of 2.75% to 3.00% as ‘the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. Sign up and join DailyFX Currency Analyst David Song LIVE to cover the CPI report.

Impact that the U.S. CPI report has had on EUR/USD during the last print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAR 2018 | 04/11/2018 12:30:00 GMT | 2.4% | 2.4% | -12 | -18 |

March 2018 U.S. Consumer Price Index (CPI)

EUR/USD 5-Minute Chart

The U.S. Consumer Price Index (CPI) picked up for the second consecutive month in March, with the headline reading climbing to an annualized 2.4% from 2.2% the month prior, while core rate advanced to 2.1% from 1.8% during the same period to also meet market expectations. A deeper look at the report showed the cost for medical care increased 0.4% during the month, with the gauge for Housing climbing 0.3%, while prices for Transportation narrowed 1.2% on the back of easing energy prices.

The initial spike in EUR/USD was short-lived, with the pair edging lower throughout the day to close at 1.2366. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

EUR/USD Daily Chart

- EUR/USD stands at risk for further losses as it extends the bearish sequence from earlier this week, with a break/close below the 1.1790 (23.6% retracement) to 1.1810 (61.8% retracement) region raising the risk for a move back towards 1.1670 (78.6% expansion) to 1.1680 (50% retracement).

- May see euro-dollar continue to work its way towards the November-low (1.1554) as both price and the Relative Strength Index (RSI) track the bearish formations from earlier this year, but the momentum indicator may foreshadow a near-term rebound in the exchange rate once the oscillator climbs above 30 and flashes a textbook buy signal.

For more in-depth analysis, check out the Q2 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.