- Headline & Core U.S. Consumer Price Index (CPI) to Narrow in January.

- Retail Sales to Increase 0.2% After Expanding 0.4% in December..

Trading the News: U.S. Consumer Price Index (CPI)

A downtick in both the headline and core U.S. Consumer Price Index (CPI) paired with signs of slowing Retail Sales may fuel the recent advance in EUR/USD as it dampens the Federal Open Market Committee’s (FOMC) scope to deliver three rate-hikes in 2018.

Even though the FOMC appears to be on course to deliver a March rate-hike, evidence of greater-than-expected economic slack may push Chairman Jerome Powell and Co. to adopt a cautious tone as inflation continues to run below the 2% target. In turn, another batch of lackluster data prints may trigger a bearish reaction in the U.S. dollar as it encourages Fed officials to project a more shallow path for the benchmark interest rate.

Nevertheless, a slew of positive development may prop up the greenback as it should keep the FOMC on course to implement higher borrowing-costs over the comings. Want more insight? Sign up & join DailyFX Currency Strategist Christopher Vecchio LIVE to cover the U.S. CPI report.

Impact that the U.S. CPI report has had on EUR/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

DEC 2017 | 01/12/2018 13:30 GMT | 2.1% | 2.1% | -6 | +64 |

December 2017 U.S. Consumer Price Index (CPI)

EUR/USD 5-Minute Chart

The U.S. Consumer Price Index (CPI) narrowed to an annualized 2.1% from 2.2% in November, while the core rate of inflation unexpectedly climbed 1.8% during the same period amid forecasts for 1.7% print. A separate report showed Retail Sales climbing 0.4% in December amid projections for a 0.5% print, while Average Hourly Earnings increased 0.4% during the month.

The mixed set of data prints sparked a choppy reaction in EUR/USD, but the greenback struggled to hold its ground throughout the day as the pair closed at 1.2203. New to trading? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

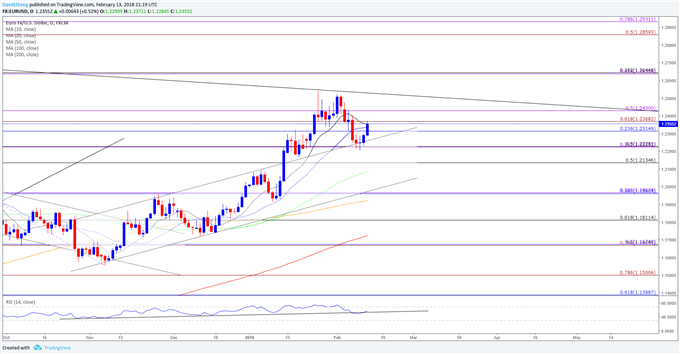

EUR/USD Daily Chart

For additional resources, download and review the FREE DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

- Topside targets are coming back on the radar for EUR/USD as it initiates a fresh series of higher highs & lows following the string of failed attempts to close below the 1.2230 (50% retracement).

- Need a break/close above the 1.2430 (50% expansion) region to favor a run at the 2018-high (1,2538), with the next topside hurdle coming in around 1.2640 (61.8% expansion) to 1.2650 (38.2% retracement) followed by the by the Fibonacci overlap around 1.2860 (50% expansion) to 1.2930 (78.6% expansion).

- Keeping a close eye on the Relative Strength Index (RSI) as it appears to be reversing course, with a move back above 70 raising the risk for a further advance in the exchange rate as the bullish momentum gathers pace.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.