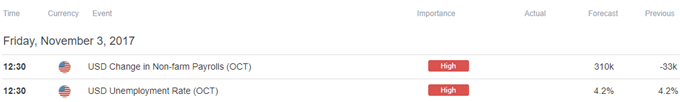

- U.S. Non-Farm Payrolls (NFP) to Rebound 310K- Biggest Advance Since October 2015.

- Average Hourly Earnings to Narrow for First Time Since April.

Trading the News: U.S. Non-Farm Payrolls (NFP)

A marked rebound in U.S. Non-Farm Payrolls (NFP) may undermine the recent rebound in EUR/USD as it puts pressure on the Federal Open Market Committee (FOMC) to deliver a December rate-hike.

Keep in mind, job growth is anticipated to pick up following two major hurricanes in September, and signs of a resilient labor market may keep the FOMC on course to further normalize policy as ‘past experience suggests that the storms are unlikely to materially alter the course of the national economy over the medium term.’ In turn, Chair Janet Yellen and Co. may prepare U.S. households and businesses for higher borrowing-costs ahead of its last 2017 meeting on December 13, but a slowdown in Average Hourly Earnings may weigh on the dollar as the central bank struggles to achieve the 2% target for inflation.

With that said, the FOMC may endorse a wait-and-see approach for 2018 as ‘market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed,’ and the greenback may face a more bearish fate over the coming months should the upcoming rotation within the committee drag on interest-rate expectations.

Impact that the U.S. NFP report had on EUR/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

SEP 2017 | 10/06/2017 12:30:00 GMT | 80K | -33K | -1 | +41 |

September 2017 U.S. Non-Farm Payrolls (NFP)

EUR/USD 5-Minute Chart

U.S. Non-Farm Payrolls (NFP) unexpectedly slipped 33K in September following two major hurricanes, while the Unemployment Rate narrowed to an annualized 4.2% from 4.4% during the same period even as the Labor Force Participation Rate widened to 63.1% from 62.9% in August. At the same time, Average Hourly Earnings picked up to 2.9% per annum from a revised 2.7% to mark the fastest pace of growth since December, and the ongoing improvement in labor force dynamics may encourage the Federal Open Market Committee (FOMC) to deliver another rate-hike in 2017 as the economy approaches full-employment.

The U.S. dollar initially gained ground following the fresh figures, but the market reaction was short-lived, with EUR/USD climbing back above the 1.1700 handle to end the day at 1.1734.

EUR/USD Daily Chart

- Near-term outlook for EUR/USD remains tilted to the downside as a head-and-shoulders formation unfolds, with both price and the Relative Strength Index (RSI) still tracking the bearish formations carried over from the summer months.

- However, the failed attempt to clear the 1.1580 (100% expansion) hurdle raises the risk for a near-term rebound especially as the RSI bounces back ahead of oversold territory.

- A close back above the former-support zone around 1.1670 (50% retracement) raises the risk for a move towards 1.1810 (61.8% retracement) to 1.1860 (161.8% expansion), which broadly lines up with channel resistance, with the next topside hurdle coming in around 1.1960 (38.2% retracement).

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link