- U.S. Gross Domestic Product (GDP) to Slow to Annualized 2.6% in 3Q 2017.

- Core Personal Consumption Expenditure (PCE) to Rebound From Lowest Level Since 1Q 2015.

Trading the News: U.S. Gross Domestic Product (GDP)

The advance 3Q U.S. Gross Domestic Product (GDP) report may generate a mixed market reaction as the growth rate is expected to narrow to an annualized 2.6%, while the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, is anticipated to pick up during the same period.

Market participants are likely to pay increased attention to the inflation figures as the Federal Open Market Committee (FOMC) strives to achieve the 2% objective, and signs of heightening price pressures may generate a bullish reaction in the greenback especially as Chair Janet Yellen and Co. appear to be on course to deliver a December rate-hike.

However, a batch of lackluster data prints may dampen the appeal of the greenback as it undermines the Fed’s scope to implement higher borrowing-costs, and a growing number of central bank officials may start to project a more shallow path for the benchmark interest rate as ‘the low inflation readings this year might reflect not only transitory factors, but also the influence of developments that could prove more persistent.’

Impact that the U.S. GDP report has had on EUR/USD during the previous quarter

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

2Q A 2017 | 07/28/2017 12:30:00 GMT | 2.7% | 2.6% | +9 | +27 |

2Q 2017 U.S. Gross Domestic Product (GDP)

EUR/USD 15-Minute Chart

The U.S. economy grew an annualized 2.6% during the three-months through June, with the a deeper look at the report showing a downward revision for the 1Q print to1.2% from 1.4%. At the same time, the gauge for Personal Consumption increased 2.8% versus 1.9% during the first three-months of 2017, while the core Personal Consumption Expenditure, the Fed’s preferred gauge for inflation, slowed to 0.9% per annum from 1.8% during the same period. The U.S. dollar struggled to hold its ground following the mixed batch of data, with EUR/USD bouncing back from the 1.1715 region to end the day at 1.1749.

New to Forex? Get started with this Free Beginners Guide

How To Trade This Event Risk

Bullish USD Trade: Growth & Inflation Figures Exceed Market Forecast

- Need a red, five-minute candle following the fresh figures to consider a short EUR/USD setup.

- If the market reaction favors a bullish dollar trade, sell EUR/USD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Advance 3Q U.S. GDP Report Disappoints

- Need a green, five-minute EUR/USD candle to consider a long EUR/USD setup.

- Implement the same approach as the bullish dollar position, just in reverse.

Potential Price Targets For The Release

EUR/USD Daily Chart

- Downside targets are back on the radar following the European Central Bank (ECB) interest rate decision as EUR/USD snaps the monthly-opening range and trades below the 100-Day SMA (1.1673) for the first time since April.

- A head-and-shoulders formation appears to be taking shape, with EUR/USD at risk for a larger correction as long as price and the Relative Strength Index (RSI) preserve the downward trends carried over from the summer months.

- Next downside region of interest comes in around 1.1580 (100% expansion) followed by the Fibonacci overlap around 1.1480 (78.6% expansion) to 1.1500 (78.6%n expansion).

- Interim Resistance: 1.2092 (2017-high) to 1.2150 (50% retracement)

- Interim Support: 1.1390 (61.8% retracement) to 1.1400 (61.8% expansion)

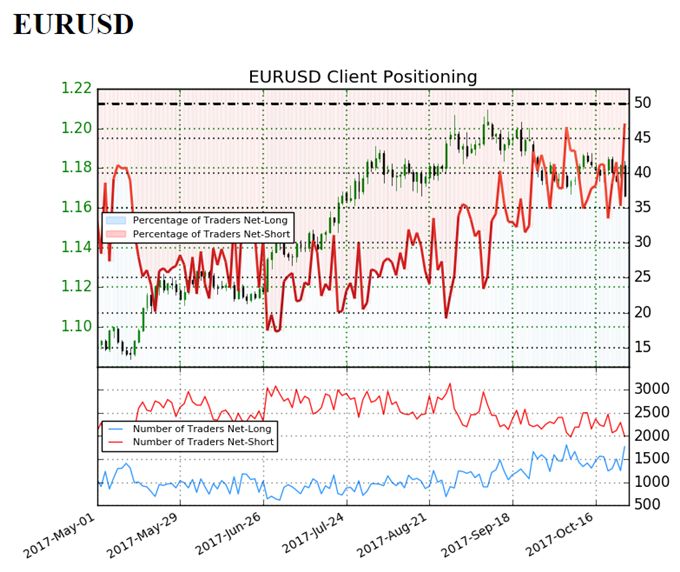

EUR/USD Retail Sentiment

Click Here to Learn How Shifts in Retail Position/Sentiment Impact Trend!

Retail trader data shows 47.1% of traders are net-long EUR/USD with the ratio of traders short to long at 1.12 to 1.

The number of traders net-long is 26.4% higher than yesterday and 23.6% higher from last week, while the number of traders net-short is 9.7% lower than yesterday and 18.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link