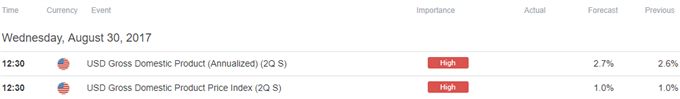

- U.S. 2Q GDP to Expand Annualized 2.7%- Fastest Pace of Growth Since 3Q 2016.

- Core PCE to Hold Steady at 0.9% per Annum; Lowest Reading Since 1Q 2015.

- Sign Up for the DailyFX Trading Webinars for an opportunity to discuss potential trade setups.

Trading the News: U.S. Gross Domestic Product (GDP)

The preliminary 2Q U.S. Gross Domestic Product (GDP) report may deter the near-term rally in EUR/USD as the updated figures are anticipated to show an upward revision in the growth rate.

Why Is This Event Important:

Signs of a stronger-than-expected activity may spark a bullish reaction in the U.S. dollar as it encourages the Federal Open Market Committee (FOMC) to further normalize monetary policy sooner rather than later. As a result, Chair Janet Yellen and Co. may stay on course to deliver three rate-hikes in 2017 especially as the real economy approaches full-employment.

However, the FOMC may attempt to buy more time at the next interest rate decision on September 20 as the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, sits at the lowest level since 2015. In turn, the central bank may carry the current policy into 2016 as many Fed officials ‘saw some likelihood that inflation might remain below 2 percent for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside.’

Impact that the U.S. GDP report has had on EUR/USD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

1Q P 2017 | 05/26/2017 12:30:00 GMT | 0.9% | 1.2% | -24 | -14 |

1Q P 2017 U.S. Gross Domestic Product (GDP)

EUR/USD 10-Minute Chart

The preliminary 1Q Gross Domestic Product (GDP) report showed an upward revision in the growth rate, with the economy expanding an annualized 1.2% during the first three-months of 2017. At the same time, the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, advanced an annualized 2.1% during the same period amid forecasts for a 2.0% print, while Personal Consumption showed a similar dynamic as the figure climbed to 0.6% from an initial print of 0.3%. The U.S. dollar gained ground followed the better-than-expected GDP report, with EUR/USD holding below the 1.1200 handle throughout the day to close at 1.1179.

How To Trade This Event Risk(Video)

Bullish USD Trade: 2Q GDP Report Instills Improved Outlook

- Need a red, five-minute candle subsequent to the GDP report to consider a short EUR/USD trade.

- If the market reaction favors a bullish dollar position, sell EUR/USD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Growth and Inflation Falls Short of Market Forecast

- Need a green, five-minute EUR/USD candle to consider a short dollar position.

- Implement the same approach as the bullish dollar trade, just in reverse.

Potential Price Targets For The Release

EUR/USD Daily Chart

Check out our EUR/USD quarterly projections in our FREE DailyFX Trading Forecasts

- Near-term outlook for EUR/USD remains constructive as a bull-flag unfolds, with the pair finally filling the gap from January-2015 (1.2000 down to 1.1955).

- Another close above the 1.1960 (38.2% retracement) hurdle may spark a run at the 1.2130 (50% retracement) region as initiates a series of higher highs & lows; keeping a close eye on the Relative Strength Index (RSI as it attempts to push into overbought territory.

- Interim Resistance: 1.2320 (23.6% retracement) to 1.2370 (61.8% expansion)

- Interim Support: 1.1390 (61.8% retracement) to 1.1400 (61.8% expansion)

EUR/USD Retail Sentiment

Retail trader data shows 25.7% of traders are net-long EUR/USD with the ratio of traders short to long at 2.88 to 1. In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.08143; price has moved 11.0% higher since then. The number of traders net-long is 3.5% lower than yesterday and 23.4% lower from last week, while the number of traders net-short is 4.3% lower than yesterday and 13.8% higher from last week.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link