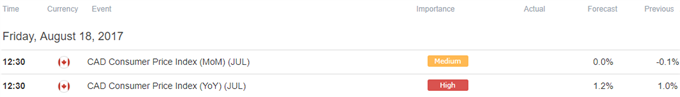

- Canada Consumer Price Index (CPI) to Pick Up for First Time Since January.

- Core Inflation Unexpectedly Climbed an Annualized 1.4% in June.

Trading the News: Canada Consumer Price Index (CPI)

USD/CAD stands at risk of extending the decline following the Federal Open Market Committee (FOMC) Minutes as Canada’s Consumer Price Index (CPI) is projected to increase for the first time since January.

Signs of rising price pressures may push the Bank of Canada (BoC) to deliver another rate-hike in 2017, and the central bank may adopt a more aggressive approach in normalizing monetary policy as ‘the output gap is now projected to close around the end of 2017, earlier than the Bank anticipated in its April Monetary Policy Report (MPR).’ In turn, Governor Stephen Poloz and Co. may prepare Canadian households and businesses for higher borrowing-costs at the next meeting on September 6 especially as ‘the factors behind soft inflation appear to be mostly temporary.’

However, a dismal development may prop up USD/CAD as it encourages the BoC to keep the benchmark interest rate on hold throughout the remainder of the year.

Impact that the CPI report has had on USD/CAD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUN 2017 | 07/21/2017 12:30:00 GMT | 1.1% | 1.0% | -49 | -61 |

June 2017 Canada Consumer Price Index (CPI)

USD/CAD 5-Minute

DailyFX 3Q Forecasts Are Now Available

Canada’s Consumer Price Index (CPI) slowed for the second straight month in June, with the headline reading narrowing to an annualized 1.0% from 1.3% the month prior to mark the slowest pace of growth since October 2015. Nevertheless, the core rate of inflation unexpectedly climbed to an annualized 1.4% from 1.3% during the same period to highlight to first rise since December 2016. The Canadian dollar advanced against its U.S. counterparts despite the batch of mixed data prints, with USD/CAD slipping below the 1.2600 handle to end the day at 1.2541.

How To Trade This Event Risk(Video)

Bullish CAD Trade: Headline & Core Inflation Picks Up in July

- Need a red, five-minute candle subsequent to the release to consider a short USD/CAD trade.

- If market reaction favors a bullish loonie position, sell USD/CAD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish CAD Trade: Canada CPI Report Disappoints

- Need a green, five-minute USD/CAD candle to consider a short loonie position.

- Implement the same setup as the bullish loonie trade, just in the opposite direction.

Potential Price Targets For The Release

USD/CAD Daily Chart

Chart - Created Using Trading View

- The rebound from the July-low (1.2413) may continue to unravel as USD/CAD threatens the upward trend carried over from the previous month; the Fibonacci overlap around 1.2770 (38.2% expansion) to 1.2780 (38.2% expansion) may continue to offer resistance especially as the pair initiates a series of lower highs & lows.

- Another close below the near-term hurdle around 1.2620 (50% retracement) to 1.2640 (61.8% expansion) may spur a move back towards the Fibonacci overlap around 1.2510 (78.6% retracement) to 1.2540 (61.8% expansion), with the next region of interest coming in around 1.2410 (100% expansion) to 1.2440 (23.6% expansion), which larger lines up with the 2017-low (1.2413).

- Interim Resistance: 1.2940 (38.2% expansion) to 1.2980 61.8% retracement)

- Interim Support: 1.2410 (100% expansion) to 1.2440 (23.6% expansion)

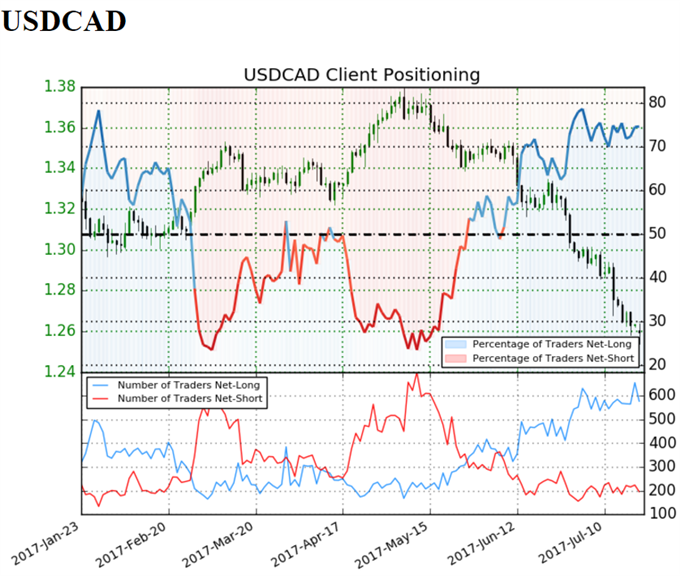

USD/CAD Retail Sentiment

Track Retail Sentiment in Real-Time with the New Gauge Developed by DailyFX

Retail trader data shows 74.6% of traders are net-long USD/CAD with the ratio of traders long to short at 2.94 to 1. In fact, traders have remained net-long since June 07 when USDCAD traded near 1.3481; price has moved 6.6% lower since then. The number of traders net-long is 12.7% lower than yesterday and 1.0% lower from last week, while the number of traders net-short is 17.3% lower than yesterday and 9.7% lower from last week.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.