- Australia Employment to Increase for Nine Consecutive Months.

- Jobless Rate to Pick Up from Lowest Reading Since 2013.

- Sign Up for LIVE Events & Key Data Coverage with the DailyFX Team.

Trading the News: Australia Employment Change

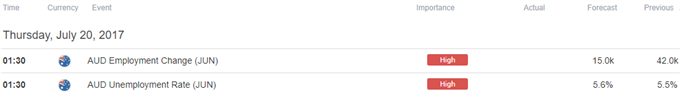

A 15.0K expansion in Australia Employment may generate fresh 2017-highs in AUD/USD as it puts pressure on the Reserve Bank of Australia (RBA) to lift the official cash rate off of the record-low.

Why Is This Event Important:

A further improvement in the labor market conditions may encourage RBA officials to alter the course for monetary policy as the central bank now forecasts ‘a neutral nominal cash rate of around 3½ per cent, given that medium-term inflation expectations were well anchored around 2½ per cent.’ In turn, Governor Philip Lowe and Co. may start to prepare Australian households and businesses for higher borrowing-costs as ‘the data available for the June quarter had generally been positive,’ but a dismal development may push the central bank to buy more time as ‘members noted that there were still risks to consumption growth should household income growth remain subdued, particularly given the high levels of household debt.’

Impact Australia Employment report has had on AUD/USD during the last print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUN 2017 | 06/15/2017 01:30:00 GMT | 10.0K | 42.0K | +26 | -8 |

June 2017 Australia Employment Change

AUD/USD 5-Minute

DailyFX 3Q Forecasts Are Now Available

The Australian economy added another 42.0K jobs following a 46.1K expansion in April, while the jobless rate unexpectedly narrowed to an annualized 5.5% from 5.7% to mark the lowest reading since 2013. A deeper look at the report showed full-time positions increased 52.1K in May, while part-time employment slipped 10.1K during the same period.

How To Trade This Event Risk(Video)

Bullish AUD Trade: Employment Rises Another 15.0K or More

- Need a green, five-minute candle following the report to consider a long AUD/USD trade.

- If the market reaction favors a bullish aussie position, buy AUD/USD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish AUD Trade: Australia Labor Report Disappoints

- Need a red, five-minute candle to favor a short aussie trade.

- Implement the same setup as the bullish AUD position, just in the opposite direction.

Potential Price Targets For The Release

AUD/USD Daily Chart

Chart - Created Using Trading View

- A material shift in market behavior appears to be underway as AUD/USD breaks out of the 2016-range, with the Relative Strength Index (RSI) sitting in oversold territory for the first time since 2014; need to see the oscillator push below 70 to raise the risk for a near-term pullback.

- Until then, topside targets remain on the radar as the momentum indicator pushes deeper into overbought territory, with the next hurdle coming in around 0.8020 (38.2% expansion) followed by the 0.8150 (100% expansion) region.

- Interim Resistance: 0.8270 (38.2% retracement) to 0.8295 (2015-high)

- Interim Support: 0.7720 (23.6% retracement) to 0.7740 (78.6% expansion)

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.