- New Zealand CPI to Slow from Fastest Pace of Growth Since 3Q 2011.

- Will Governor Graeme Wheeler Continue to Endorse a Wait-and-See Approach?

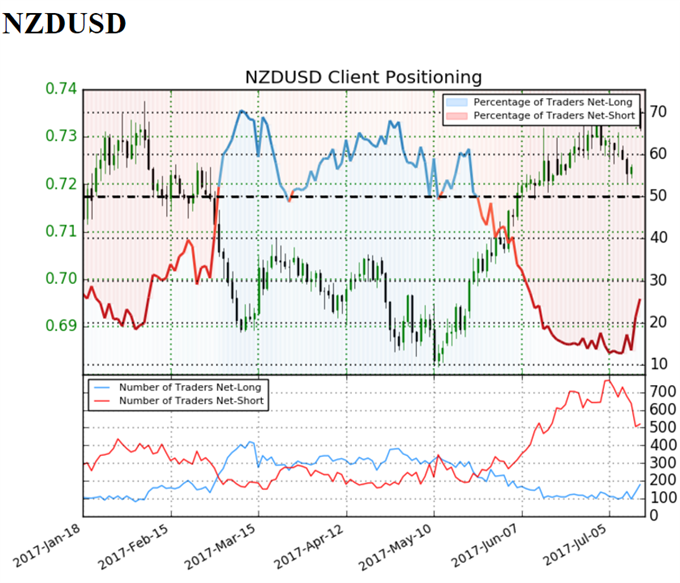

- NZD/USD Retail Sentiment Narrows From Extreme as Net-Longs Jump 65.1%.

Trading the News: New Zealand Consumer Price Index (CPI)

A marked slowdown in New Zealand’s Consumer Price Index (CPI) may spark a bearish reaction in NZD/USD as it encourages the Reserve Bank of New Zealand (RBNZ) to keep the cash rate at the record-low throughout 2017.

Why Is This Event Important:

With Governor Graeme Wheeler scheduled to depart in September, the RBNZ appears to be on course to retain the current policy for the foreseeable future as the central bank argues ‘The increase in headline inflation in the March quarter was mainly due to higher tradables inflation.’ As a result, the RBNZ may continue to endorse a wait-and-see approach at the next meeting on August 10 as officials warn ‘GDP growth in the March quarter was lower than expected.’

Impact that the CPI report has had on NZD/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

1Q 2017 | 04/19/2017 22:45:00 GMT | 2.0% | 2.2% | +34 | +7 |

1Q 2017 New Zealand Consumer Price Index (CPI)

NZD/USD 15-Minute

New Zealand’s headline reading for inflation climbed to an annualized 2.2% from 1.3% during the last three-months of 2016 to mark the fastest pace of growth since 2011. Signs of heightening price pressures may push the Reserve Bank of New Zealand (RBNZ) to alter the monetary policy outlook, but Governor Graeme Wheeler appears to be in no rush to lift the official cash rate off of the record-low as ‘numerous uncertainties remain, particularly in respect of the international outlook, and policy may need to adjust accordingly.’ The New Zealand dollar gained ground following the CPI report, but the market reaction was short-lived, with the pair pulling back from a high of 0.7052 to end the day at 0.7011.

How To Trade This Event Risk(Video)

Bearish NZD Trade: 2Q CPI Highlights Easing Price Pressures

- Need a red five-minute candle following the report to consider a short NZD/USD trade.

- If market reaction favors a bearish kiwi position, sell NZD/USD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish NZD Trade: Headline Inflation Continues to Exceed Market Expectations

- Need a green, five-minute candle to consider a long NZD/USD trade.

- Carry out the same setup as the bearish kiwi trade, just in the opposite direction.

Potential Price Targets For The Release

NZD/USD Daily

DailyFX 3Q ForecastsAre Now Available

- Failure to test the 2017-high (0.7376) may open up the downside targets for NZD/USD as the rebound from the May-low (0.6818) shows signs of exhaustion; the unsuccessful attempts to close above the 0.7350 (23.6% expansion) hurdle raises the risk for a near-term decline in the kiwi-dollar exchange rate especially as the Relative Strength Index (RSI) deviates with price and preserves the bearish formation carried over from the previous month.

- In turn, a move back below the Fibonacci overlap around 0.7240 (61.8% retracement) to 0.7260 (78.6% retracement) may spur a move back towards the 0.7200 (38.2% retracement) handle, with the next downside hurdle coming in around 0.7160 (61.8% retracement).

- Interim Resistance: 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion)

- Interim Support: 0.6820 (23.6% retracement) to 0.6850 (38.2% retracement)

Track Retail Sentiment with the New Gauge Developed by DailyFX Based on Trader Positioning

Retail trader data shows 25.7% of traders are net-long NZD/USD with the ratio of traders short to long at 2.89 to 1. In fact, traders have remained net-short since May 24 when NZD/USD traded near 0.68901; price has moved 6.2% higher since then. The percentage of traders net-long is now its highest since June 09 when NZD/USD traded near 0.72103. The number of traders net-long is 25.0% higher than yesterday and 65.1% higher from last week, while the number of traders net-short is 2.2% higher than yesterday and 27.8% lower from last week.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.