- U.S. Consumer Price Index (CPI) to Narrow for Fourth Consecutive Month in June.

- Core Rate to Hold Steady at Annualized 1.7%- Slowest Pace of Growth Since 2015.

- Join DailyFX Market Analyst Nick Cawley LIVE to Cover the U. of Michigan Confidence Survey.

Trading the News: U.S. Consumer Price Index (CPI)

Another downtick in the U.S. Consumer Price Index (CPI) may spur a rebound in EUR/USD as the Federal Open Market Committee (FOMC) appears to be scaling back its hawkish outlook for monetary policy.

Why Is This Event Important:

Even though U.S. Retail Sales are projected to increase in June, the prepared remarks for the Humphrey-Hawkins testimony appears to have rattled interest-rate expectations as market participants scale back bets for a December rate-hike. Signs of subdued price pressures may spark a bearish reaction in the greenback, and the Federal Open Market Committee (FOMC) may largely endorse a wait-and-see approach at the next rate decision on July 26 as Chair Yellen warns ‘inflation continues to run below our 2 percent objective and has declined recently.’

Nevertheless, a positive development may push the FOMC to implement a more aggressive approach in normalizing monetary policy amid the growing discussion to unload the balance sheet.

Impact that the U.S. CPI report has had on EUR/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAY 2017 | 06/14/2017 12:30:00 GMT | 2.0% | 1.9% | +67 | +15 |

May 2017 U.S. Consumer Price Index (CPI)

EUR/USD 5-Minute

DailyFX 3Q Forecasts Been Released and Are Available in Our Trading Guides

The U.S. Consumer Price Index (CPI) weakened for the third straight month in May, with the headline reading slipping to an annualized 1.9% from 2.2% in April. At the same time, the core reading unexpectedly narrowed to 1.7% per annum during the same period to mark the slowest pace of growth since May 2015, and signs of subdued price pressures may encourage the Fed to buy more time as the central bank struggles to achieve the 2% target for inflation. The U.S. dollar lost ground following the dismal CPI report, with EUR/USD clearing the 1.1250 zone, but the market reaction as short-lived as the pair closed the day at 1.1218.

How To Trade This Event Risk(Video)

Bearish USD Trade: U.S. CPI Report Drags on Interest-Rate Expectations

- Need a green, five-minute candle following to the data prints to consider a long EUR/USD position.

- If the market reaction favors a bearish dollar trade, buy EUR/USD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish USD Trade: Price Growth & Household Consumption Exceeds Market Forecast

- Need a red, five-minute EUR/USD candle to favor a long dollar position.

- Implement the same approach as the bearish dollar trade, just in the opposite direction.

Potential Price Targets For The Release

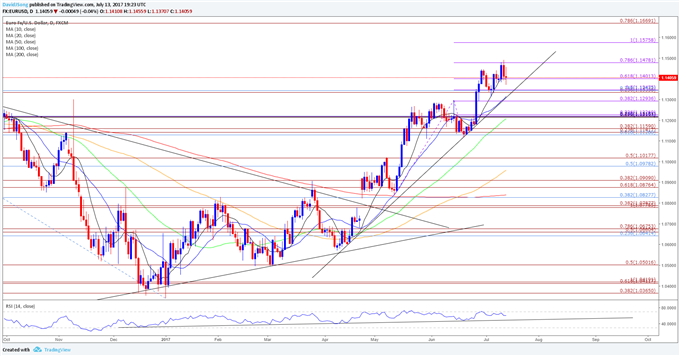

EUR/USD Daily

Chart - Created Using Trading View

- EUR/USD has pulled back from a fresh 2017-high (1.1490), but the near-term outlook remains constructive as long as the pair holds above the monthly-low (1.1312), which largely lines up with the former-resistance zone around 1.1290 (38.2% expansion).

- Will keep a close eye on the Relative Strength Index (RSI) as it pulls back from overbought territory, but the shift in market behavior may continue to unfold in the second-half of 2017 as price and the momentum indicator preserve the bullish trends from late last year.

- Need a close above the 1.1480 (78.6% expansion) hurdle to open up the next topside region of interest around 1.1580 (100% expansion).

- Interim Resistance: 1.1616 (2016-high) to 1.1670 (78.6% expansion)

- Interim Support: 1.0980 (50% retracement) to 1.1020 (50% expansion)

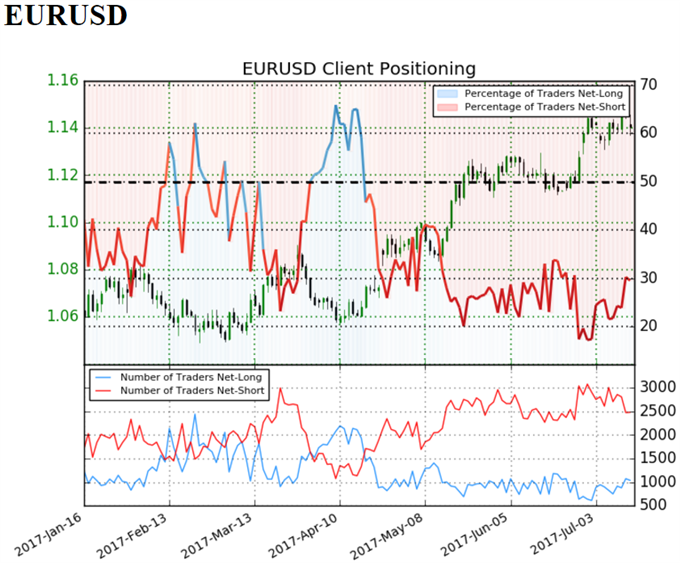

Retail trader data shows 29.6% of traders are net-long EUR/USD with the ratio of traders short to long at 2.38 to 1. In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.06683; price has moved 6.9% higher since then. The number of traders net-long is 1.7% lower than yesterday and 4.1% higher from last week, while the number of traders net-short is 0.6% lower than yesterday and 10.0% lower from last week. For more information on retail sentiment, check out the new gauge developed by DailyFX based on trader positioning.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link