- Reserve Bank of Australia (RBA) to Keep Official Cash Rate at Record-Low of 1.50%.

-Will Governor Philip Lowe Continue to Endorse a Wait-and-See Approach?

Trading the News: Reserve Bank of Australia (RBA) Interest Rate Decision

The Reserve Bank of Australia (RBA) interest rate decision may drag on AUD/USD as the central bank appears to be in no rush to lift the official cash rate off of the record-low.

Why Is This Event Important:

Governor Philip Lowe & Co. may merely try to buy more time as ‘slow growth in real wages is restraining growth in household consumption,’ and the central bank may stay on the sidelines throughout the remainder of the year as ‘the outlook continues to be supported by the low level of interest rates.’ However, the RBA may gradually change its tune in the second-half of 2017 as ‘the transition to lower levels of mining investment following the mining investment boom was almost complete,’ and a hawkish policy statement may trigger a bullish reaction in the Australia dollar as it boosts interest-rate expectations.

Have a question about the currency markets? Join a Trading Q&A webinar and ask it live!

Impact that the RBA rate decision has had on AUD/USD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUN 2016 | 06/06/2017 04:30:00 GMT | 1.50% | 1.50% | +15 | +31 |

June 2017 Reserve Bank of Australia (RBA) Interest Rate Decision

AUD/USD 5-Minute

As expected, the Reserve Bank of Australia (RBA) kept the official cash rate at the record-low of 1.50% in June, and it seems as though Governor Philip Lowe and Co. remains in no rush to normalize monetary policy as ‘slow growth in real wages is restraining growth in household consumption.’ Even though officials note ‘the transition to lower levels of mining investment following the mining investment boom is almost complete,’ the central bank may retain the wait-and-see approach throughout 2017 as ‘the outlook continues to be supported by the low level of interest rates.’ The initial market reaction was short-lived, with AUD/USD largely holding its ground throughout the day as the pair closed at 0.7507.

How To Trade This Event Risk(Video)

Bearish AUD Trade: RBA Attempts to Buy More Time

- Need a red, five-minute candle following the rate decision to consider a short AUD/USD position.

- If the market reaction favors a bearish aussie trade, sell AUD/USD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish AUD Trade: Governor Lowe & Co. Adopt Hawkish Tone

- Need a green, five-minute candle to favor a long aussie trade.

- Implement the same setup as the bearish AUD position, just in reverse.

Potential Price Targets For The Release

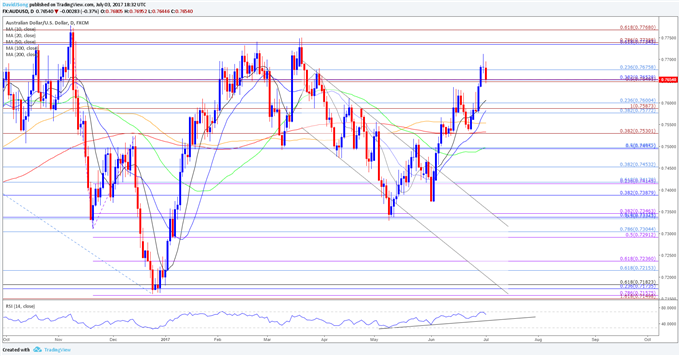

AUD/USD Daily

Chart - Created Using Trading View

- Broader outlook remains relatively flat as AUD/USD continues to operate within the 2016-range; failed attempt to test the March-high (0.7749) may stoke a near-term pullback in the exchange rate especially as the Relative Strength Index (RSI) turns around ahead of overbought territory.

- In turn, a close below the 0.7650 (50% expansion) hurdle may opening up the next downside region of interest around 0.7580 (38.2% retracement) to 0.7600 (23.6% retracement) followed by 0.7530 (38.2% expansion), which lines up with the 200-Day SMA (0.7533).

- Interim Resistance: 0.7730 (61.8% retracement) to 0.7770 (61.8% expansion)

- Interim Support: 0.7150 (161.8% expansion) to 0.7180 (61.8% retracement)

Make Sure to Check Out the DailyFX Guides for Additional Trading Ideas!

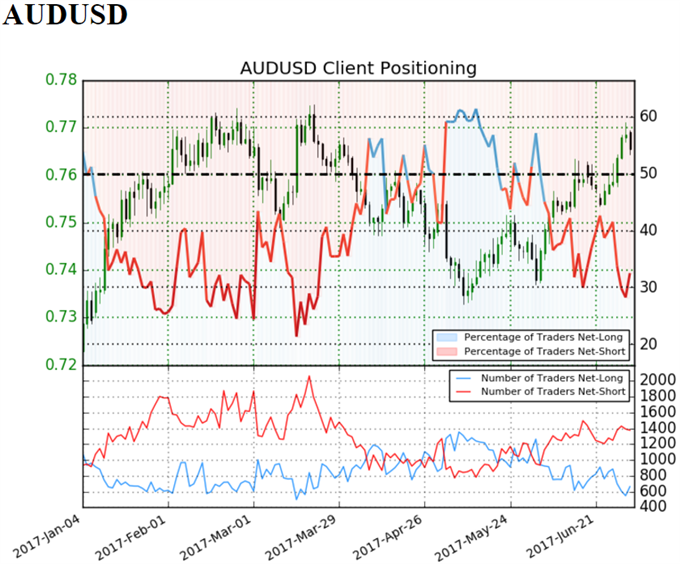

Retail trader data shows 32.5% of traders are net-long with the ratio of traders short to long at 2.08 to 1. In fact, traders have remained net-short since Jun 04 when AUDUSD traded near 0.73799; price has moved 3.7% higher since then. The number of traders net-long is 14.1% higher than yesterday and 23.3% lower from last week, while the number of traders net-short is 1.3% lower than yesterday and 8.4% higher from last week.For more information on retail sentiment, check out the new gauge developed by DailyFX based on trader positioning.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.