- U.K. Retail Sales to Contract for First Time Since December.

- Will Slower Consumption Encourage the BoE to Further Delay Normalizing Monetary Policy?

For more updates, sign up for David's e-mail distribution list.

Trading the News: U.K. Retail Sales

The U.K. Retail Sales report may produce headwinds for the British Pound and drag on GBP/USD as signs of a slowing recovery provides the Bank of England (BoE) with greater scope to further delay its normalization cycle.

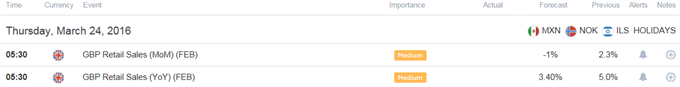

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though BoE argues that the next policy move will be to lift the benchmark interest rate off of the record-low, the Monetary Policy Committee (MPC) may preserve its current policy throughout 2016 in an effort to mitigate the downside risks surrounding the real economy.

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| CBI Trends Total Orders (MAR) | -14 | -14 |

| NIESR GDP Estimate (FEB) | -- | 0.3% |

| GfK Consumer Confidence (FEB) | 3 |

The recent weakness in household sentiment accompanied by the slowdown in economic activity may drag on private-sector consumption, and a dismal sales report may spur a bearish reaction in GBP/USD as market participants push out bets for a BoE rate-hike.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Jobless Claims Change (FEB) | -9.1K | -18.0K |

| Average Hourly Earnings ex. Bonus (3MoY) (JAN) | 2.1% | 2.2% |

| Net Consumer Credit (JAN) | 1.4B | 1.6B |

Nevertheless, the expansion in private-sector lending paired with the ongoing improvement in labor-market dynamics may boost household spending, and a positive development may generate a near-term rebound in GBP/USD as it puts pressure on Governor Mark Carney and Co. to normalize monetary policy sooner rather than later.

How To Trade This Event Risk(Video)

Bearish GBP Trade: Retail Sales Slips 1.0% or Greater

- Need red, five-minute candle following the GDP report to consider a short British Pound trade.

- If market reaction favors bearish sterling trade, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: U.K. Consumption Beats Market Expectations

- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The Release

GBPUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- Longer-term outlook for GBP/USD remains tilted to the downside as the BoE continues to endorse a wait-and-see approach in 2016, and the pair may continue to carve a series of lower highs & lows over the near to medium-term should the Relative Strength Index (RSI) fail to retain the bullish formation carried over from earlier this year.

- Interim Resistance: 1.4910 (61.8% retracement) to 1.4930 (38.2% expansion)

- Interim Support: 1.3870 (78.6% expansion) and 1.4000 pivot

Check out the short-term technical levels that matter for GBP/JPY heading into the report!

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

Impact that the U.K. Retail Sales Report has had on GBP during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JAN 2016 | 02/19/2016 09:30 GMT | 0.7% | 2.3% | -8 | +78 |

January 2016 U.K. Retail Sales

U.K. Retail Sales beat market expectations in January, with household spending increasing 2.3% after contracting a revised 1.3% in December. A deeper look at the report showed a meaningful rebound in discretionary spending, with sales at non-food stores increasing 3.6%, while spending on clothing & footwear advanced 3.3% during the same period. Despite the better-than-expected print, it seems as though the Bank of England (BoE) will stick to its current policy throughout the first-half of 2016 as the U.K. referendum clouds the economic outlook for the region. Nevertheless, there was a limited market reaction to the data print as GBP/USD dipped below the 1.4300 handle during the European trade, but the sterling regained its footing during the North American session to end the day at 1.4399.

Read More:

GBP/USD - Brexit Odds Repricing

EUR/USD – The Abyss Hopefully Leads to Clarity

COT-Small Trader Net Long Position in AUD is Largest Since July 2014

USD/JPY-More at the 110.66 Low Than You Might Think

Get our top trading opportunities of 2016 HERE

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand