- 3Q U.S. GDP to Expand Annualized 1.9%- Slowest Pace of Growth Since First Three-Months of 2015.

- Core PCE to Climb Annualized 1.3% After Expanding 1.9% Last Quarter.

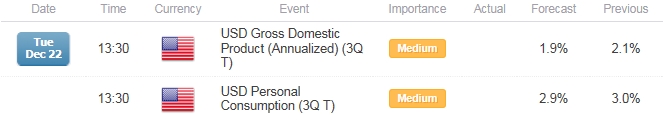

Trading the News: U.S. Gross Domestic Product (GDP)

A marked downward revision to the 3Q U.S. Gross Domestic Product (GDP) report may dampen the appeal of the greenback and spur a larger rebound in EUR/USD as fears of a slower recovery drag on interest rate expectations.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though the Federal Open Market Committee (FOMC) removes the zero-interest rate policy (ZIRP) in 2015 and remains confident in achieving the 2% inflation target over the policy horizon, the ongoing slack within the real economy may prompt the ‘data dependent’ central bank to endorse a wait-and-see approach in the first-half of 2016.

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Factory Orders (SEP) | -0.9% | -1.0% |

| Personal Spending (SEP) | 0.2% | 0.1% |

| Advance Retail Sales (MoM) (SEP) | 0.2% | 0.1% |

The slowdown in household consumption may generate a dismal GDP figure as it remains one of the leading drivers of growth, and fears of a slower recovery may spur a rift within the central bank as Chair Yellen appears to be in no rush to further normalize monetary policy.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Consumer Credit (SEP) | $18.000B | $28.918B |

| Construction Spending (MoM) (SEP) | 0.5% | 0.6% |

| Housing Starts (MoM) (SEP) | 1.4% | 6.5% |

However, the expansion in private-lending accompanied by the pickup in building activity may generate a stronger-than-expected growth report, and a positive development may trigger a near-term advance in the greenback as market participants boost bets for higher-costs in 2016.

How To Trade This Event Risk(Video)

Bearish USD Trade: U.S. Economy Expands 1.9% or Less

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD.

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: GDP Report Exceeds Market Expectations

- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in reverse.

Potential Price Targets For The Release

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- The policy divergence in the Euro-Zone and the U.S. fosters a long-term bearish outlook for EUR/USD but, the pair may continue to give back the decline following the Fed rate-hike should the 3Q GDP report dampen bets of seeing the Fed implement higher borrowing-costs in 2016.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short EUR/USD since December 12, but the ratio appears to be working its way back towards recent extremes as it slips to -1.46, with 41% of traders now long.

- Interim Resistance: 1.1052 (November high) to 1.1090 (50% retracement)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Impact that the U.S. GDP report has had on EUR/USD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

2Q F 2015 | 09/25/2015 12:30 GMT | 3.7% | 3.9% | +10 | +37 |

Final 2Q 2015 U.S. Gross Domestic Product (GDP)

The final 2Q U.S. Gross Domestic Product (GDP) report showed an upward revision in the growth rate, with the economy expanding an annualized 3.9% amid an initial forecast for a 3.7% print. In addition, Personal Consumption and the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, also exceeded market expectations and were revised up to 3.6% and 1.9%, respectively. Signs of a stronger recovery may encourage the Federal Reserve to adopt a more hawkish tone over the coming months as the economy approaches ‘full-employment,’ while Chair Janet Yellen anticipates the central bank to achieve its 2% inflation goal over the policy horizon. Despite the upward revision, there was a rather limited reaction to the data prints, with EUR/USD snapping back from the 1.1125 region to close the day at 1.1190.

*As we approach the holidays and thus illiquid markets, it's worth reviewing principles that help protect your capital. We call these principles the "Traits of Successful Traders."

Three Factors Warn of Perfect Storm in FX Markets - Caution Advised

Read More:

Price & Time: USDOLLAR - Negative December Seasonality A Dud?

DAX 30: The Euro, the Force Is Strong With This One

USD/JPY Risks Larger Pullback on Dismal US GDP, Sticky Japan CPI

Canadian Dollar Hits 11-yr Low vs. USD on Wholesales Trade Data Miss & Macro Factors

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand