- U.K. Retail Sales to Increase for Fifth Consecutive Month in March.

- Will Faster Private-Sector Consumption Encourage BoE to Sounds More Hawkish?

Trading the News: U.K. Retail Sales

Another 0.4% expansion in U.K. Retail Sales may heighten the appeal of the British Pound and prompt a near-term breakout in GBP/USD as it puts increased pressure on the Bank of England (BoE) to normalize monetary policy sooner rather than later.

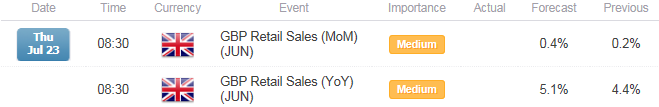

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

The more hawkish BoE Minutes suggest that the central bank remains on course to raise the benchmark interest rate off of the record-low, and signs of a stronger U.K. recovery may spur a larger dissent within the Monetary Policy Committee (MPC) as a growing number of BoE officials see a greater risk for inflation.

For more updates, sign up for David's e-mail distribution list.

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Consumer Price Index Core (YoY) (JUN) | 0.9% | 0.8% |

| NIESR GDP Estimate (JUN) | -- | 0.7% |

| GfK Consumer Confidence (MAR) | 2 | 7 |

Discounted prices along with the pickup in household confidence may generate a strong retail sales report, and a faster rate of private-consumption may boost interest rate expectations as the U.K. economy gets on a firmer footing.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Jobless Claims Change (JUN) | -9.0K | 7.0K |

| Average Hourly Earnings ex. Bonus (3MoY) (MAY) | 3.0% | 2.8% |

| Net Consumer Credit (MAY) | 1.1B | 1.0B |

However, easing private-sector credit paired with slower job growth may drag on spending, and a dismal sales print may spur a further consolidation in the exchange rate as it raises the BoE’s scope to retain its current policy stance for an extended period.

How To Trade This Event Risk(Video)

Bullish GBP Trade: Retail Sales Increases Another 0.4% or Greater

- Need green, five-minute candle following the release to consider a long British Pound trade.

- If market reaction favors bullish sterling trade, buy GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: U.K. Household Spending Disappoints

- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in opposite direction.

Join DailyFX on Demand for Real-Time Updates on the DailyFX Speculative Sentiment Index!

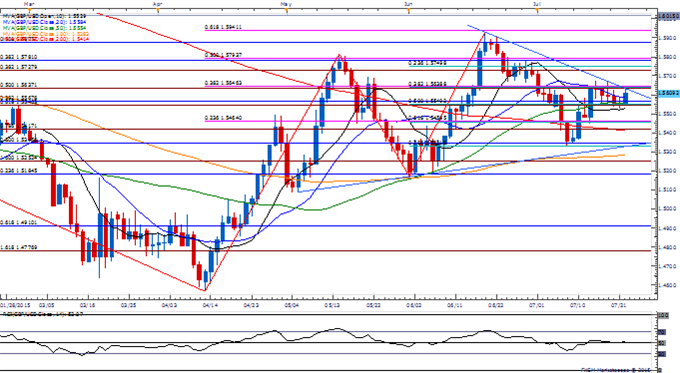

Potential Price Targets For The Release

GBP/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- Lack of momentum to close above 1.5630 (38.2% retracement) to 1.5650 (38.2% retracement) may continue to foster range-bound prices in GBP/USD as the pair remains stuck within a wedge/triangle formation.

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long following the BoE Minute, but the ratio has come off of recent extremes as it sits at +1.45 as 59% of traders are long.

- Interim Resistance: 1.5750 (23.6% retracement) to 1.5780 (38.2% retracement)

- Interim Support: 1.5330 (78.6% retracement) to 1.5350 (50% retracement)

Read More:

GBP/USD Little Changed on Day…and Year (Year Open at 1.5554)

GBP/USD Fails to Breakout on BoE Minutes- NZD to Face RBNZ

Impact that the U.K. Retail Sales report has had on GBP during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| MAY 2015 | 06/18/2015 8:30 GMT | -0.2% | 0.2% | +18 | -25 |

May 2015 U.K. Retail Sales

U.K. Retail Sales unexpectedly increased another 0.2% in May following a revised 0.8% expansion the month prior. The pickup was largely driven by increased demand for Household Goods, while consumers scaled back discretionary spending on Clothing and Footwear. Even though the Bank of England (BoE) largely endorses a wait-and-see approach, signs of a stronger U.K. recovery may put increased pressure on the central bank to normalize policy sooner rather than later as Governor Mark Carney remains confident in achieving the 2% inflation target over the policy horizon. The initial market reaction was short-lived, with GBP/USD struggling to hold above the 1.5900 handle, with the pair consolidating throughout the North American session to end the day at 1.5873.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums