Talking Points:

- The April US jobs report produced strong topline figures, but the internals of the report left much to be desired.

- The US Dollar bearish reversal after the US NFP report has helped Gold prices stave off a potentially larger breakdown.

- Changes in retail traders positioning suggest that Gold prices may have downside yet ahead.

Looking for longer-term forecasts on Gold and Silver prices? Check out the DailyFX Trading Guides.

Gold prices have had a rocky week, between the May Fed meeting and the April US Nonfarm Payrolls report. Fed Chair Jerome Powell came across as more optimistic than people anticipated regarding price pressures, initially sending the US Dollar higher and Gold lower on Wednesday.

Calling low inflation “transitory,” Fed Chair Powell seemingly sidestepped committing to more easing. After all, he has said that the FOMC would consider a policy adjustment if inflation were to be low on a “persistent” basis.

In turn, as the US Dollar and US Treasury yields ran higher on Wednesday and Thursday, Gold prices were knocked lower.

But that momentum was halted today when a superficially strong US jobs report didn’t serve as the solidifying factor for sentiment that traders were looking for. Even though the topline figure topped 200K and the unemployment rate fell to a new cycle low, wage growth missed expectations and the labor force participation rate dropped unexpectedly.

Between the May Fed meeting and the April US Nonfarm Payrolls report, prices across asset classes have carved out a range as no clear sentiment has emerged after this week's events.

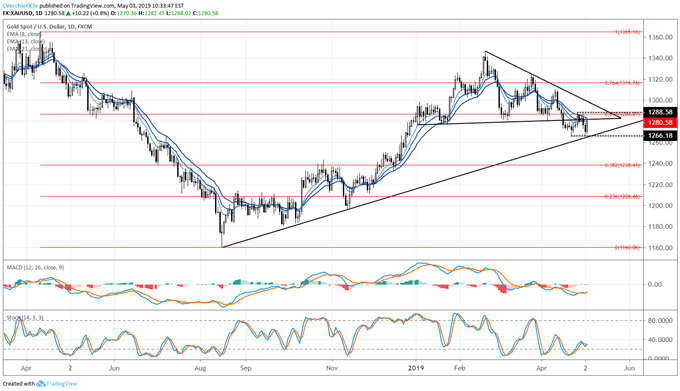

Gold Price Technical Analysis: Daily Chart (April 2018 to May 2019) (Chart 1)

Since setting a fresh yearly low on April 16, gold prices have been moving sideways around former symmetrical triangle support. But as the uptrend from the August, October, and November 2018 lows has come into focus, gold prices have been stuck trading between 1266 and 1288. This coiling effort has shifted attention away from the multi-month symmetrical triangle to the two-week sideways consolidation.

Accordingly, the gold price forecast is necessarily neutral heading into next week: a move below 1266 by mid-May would constitute a downside break of the consolidation as well as the uptrend from the late-2018 swing lows; while a move above 1288 by mid-May would constitute a topside break of the consolidation as well as the downtrend from the February and March 2019 highs.

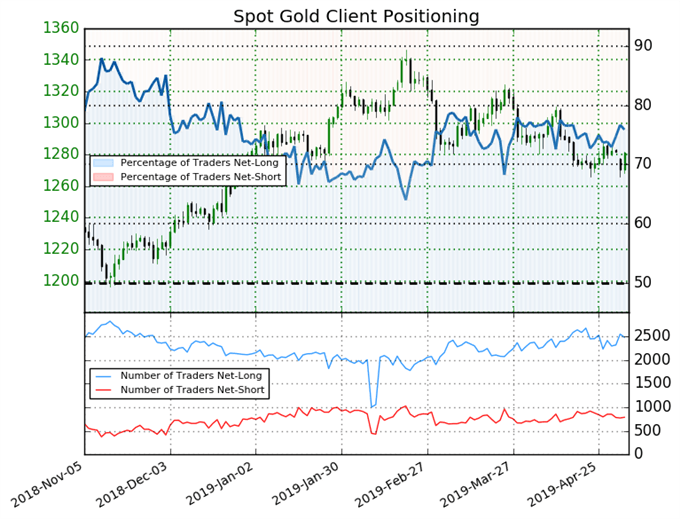

IG Client Sentiment Index: Spot Gold Price Forecast (May 3, 2019) (Chart 2)

Spot gold: Retail trader data shows 75.9% of traders are net-long with the ratio of traders long to short at 3.15 to 1. The number of traders net-long is 0.2% lower than yesterday and 3.3% lower from last week, while the number of traders net-short is 7.2% lower than yesterday and 4.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests spot gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger spot gold-bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail at cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides