Talking Points

- The US Dollar’s earlier gains around the December US Nonfarm Payrolls report were erased this morning after Fed Chair Jerome Powell spoke at the American Economic Association’s Annual Meeting.

- Fed Chair Powell’s tone has changed numerous times in recent months, but the latest shift can be easily described as the ‘Powell Put’ being triggered.

- Retail traders continue to sell the US Dollar, fading advances by EUR/USD and GBP/USD.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

The US Dollar (via the DXY Index) has seen another wave of volatility hit markets today, thanks in part to competing messages from economic data and policymakers. Following the December US Nonfarm Payroll’s report, the US Dollar was trading close to its highs of the week, with markets pushing back against the recent trend of rate cuts being priced-in for 2019.

However, whatever perceived implications for Fed policy from the jobs data were quickly clarified when Fed Chair Jerome Powell spoke at the American Economic Association’s Annual Meeting this morning. The message was clear: future rate hikes won’t materialize as quickly as previously anticipated, even if the economic data is not bearing out concerns for a recession at present time.

What is the 'Powell Put'?

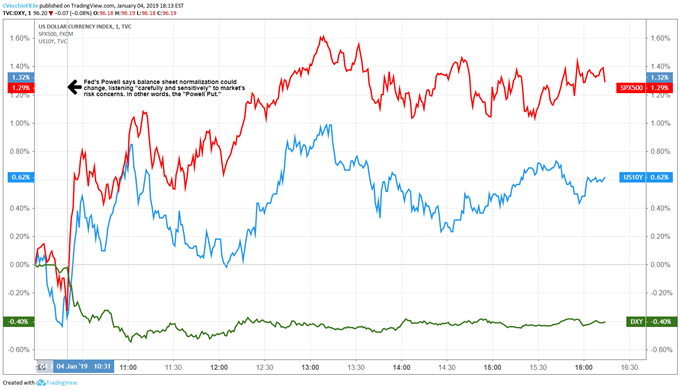

How do we know this? Look no further than how the DXY Index, the US S&P 500, and the US Treasury 10-year yield reacted after Fed Chair Powell said that the central bank was listening “carefully and sensitively” to the “market’s risk concerns” and it could “shift the process” of balance sheet normalization if necessary, as there was "no preset path for policy":

DXY Index, US S&P 500, and US Treasury 10-year Yield Percentage Change: 1-minute Timeframe (January 4, 2019 Intraday) (Chart 1)

In a sense, the “Powell Put” was triggered this morning. The “Powell Put” is much like “Bernanke Put” or the “Greenspan Put” – that investors should feel comfortable owning stocks because the Federal Reserve will step in if losses mount too quickly (in contrast, the “Yellen Put” was that the Federal Reserve would act to prevent a quick rise in interest rates). The prospect of the Fed taking its foot off of the rate hike pedal has proven bad for the US Dollar and good for stocks.

Back in November 2018, after the US midterm elections, we questioned how long it would take for the Fed and markets to resolve the dissonance over rate pricing (see: How Quickly Do Traders Spot Shifting Fed Narrative?). It seems as if the Fed is bending, reducing its own expectations for policy tightening to fall closer in line with markets are pricing in. After Fed Chair Powell’s comments this morning, Fed funds futures are pricing in a 4.3% chance of a 25-bps rate hike by December and a 33.1% chance of a 25-bps rate cut.

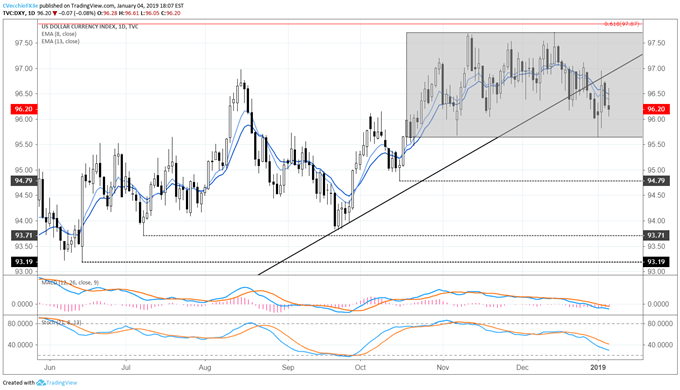

DXY Index Price Chart: Daily Timeframe (January 2018 to January 2019) (Chart 2)

Even after a second day of violent gyrations (yesterday due to the Yen flash crash, today due to NFPs and the Fed), not much has changed for the DXY Index’s technical structure. Price remains in a sideways consolidation that started in mid-October, stuck between 95.65 and 97.72.

Nevertheless, it still appears that a bearish resolution is still more likely in the near-term. Yesterday’s inside day was a failed follow-up attempt to retake its uptrend from the April and September 2018 lows, resulting in the DXY Index falling back below its daily 8-, 13-, and 21-EMA envelope. Accordingly, both daily MACD and Slow Stochastics continue to point lower as they break into bearish territory. A breach of the weekly low of 95.65 is needed to validate the bearish bias into a call for a top.

Read more: US Dollar Rallies after All-Around Strong December US Jobs Report

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail at cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides