Talking Points:

- The DXY Index remains in a holding pattern before the FOMC releases its November policy decision, trading above the Wednesday close but below Tuesday's close. .

- See the full DailyFX Webinar Calendar for upcoming strategy sessions pertaining to the November FOMC meeting.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

The US Dollar (via the DXY Index) continues to stage a minor recovery after losses set in after the close on Tuesday. Nevertheless, with price still holding above the 96.16 level, the bulls have yet to throw in the towel. Now, with the US midterm elections in the rearview mirror, traders are weighing the implications of the forthcoming FOMC rate decision.

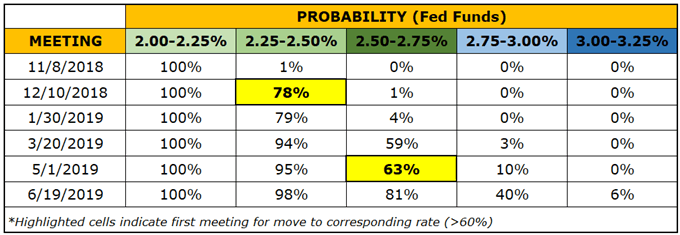

As far as FOMC meetings go, the November policy decisions should be one of the less remarkable gatherings of 2018. Rates markets continue to price in a 1% chance of a 25-bps rate hike, rendering today's meeting simply a placeholder for future gatherings.

Fed Rate Hike Expections (November 8, 2018) (Table 1)

The expectations headed into today, or lack thereof, aren't a surprise. Market participants have been conditioned to only anticipate policy changes when the FOMC produces a new Summary of Economic Projections and when the Fed Chair gives a press conference; neither of these will happen today. However, with a 78% chance of a hike in December, today's meeting will clearly be a runway for the 25-bps hike next month.

Without a new Summary of Economic Projections, that means all of the salient information regarding policy decision making will be in the sole policy statement released at 14 EST/19 GMT. But given the lack of change in either US growth or inflation expectations since the FOMC last met at the end of September (no material changes in surveys or data momentum trackers), it seems highly doubtful that the language used will shift materially (in December, we'll be curious to see how changes to the Summary of Economic Projections impact rate expectations, which are toying with pricing in the end of the Fed hike cycle at the end of 2019).

Accordingly, traders hoping for today's FOMC meeting to be a significant enough catalyst to provoke the US Dollar into a meaningful move after its post-midterms hangover may walk away disappointed.

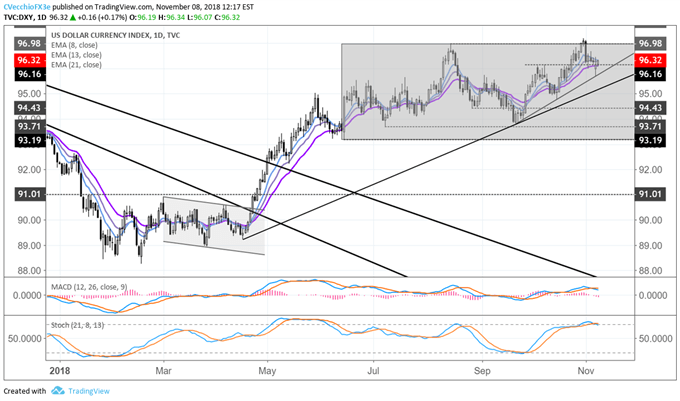

DXY Index Price Chart: Daily Timeframe (January to November 2018) (Chart 1)

The technical picture is decidely neutral for the US Dollar at the moment, although bulls are starting to gather strength. Even though momentum has stalled in recent days, price has been able to maintain action above 96.16, the early-October swing high that has been vital support over the past three-weeks. However, with the DXY Index still nestled in the middle of its daily 8-, 13-, and 21-EMA envelope, more price development is necessary before bulls retake control. For now, the uptrend from the September and October swing lows remains in place, and sustained action above 96.16 would raise the odds of bullish developments going into next week.

Read more: Markets After the US Midterms: Charts and Themes to Watch

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX