Talking Points

- New Fed Chair Jerome Powell is widely expected to express continuity of the monetary policy trajectory set in place by former Chair Janet Yellen.

- Markets are pricing in less than a 1% move in EUR/USD, GBP/USD, USD/JPY, and Gold around today's testimony.

- Retail trader sentiment suggests a mixed trading environment for the US Dollar.

Volatility is back. It's time to review the Traits of Successful Traders series to stay grounded with the tenets of risk management.

The US Dollar (via DXY Index) hasn't move all that much in the past five trading sessions (including today), as price continues to stall below two key trend levels: the downtrend from the December 18, January 11, and now February 21 highs; as well as the descending channel top off of the January 17 and February 8 highs.

Price Chart 1: DXY Index Daily Timeframe (August 2017 to February 2018)

As such, we're still of the mindset that a bottom can't be called until the DXY Index clears out 91.01, the former 2017 low and swing highs from mid-January. But if traders are looking for new Fed Chair Jerome Powell to be the catalyst for such a development, they may walk away disappointed.

In fact, taking a look at measures of overnight volatility, expectations for a significant move today are low. EUR/USD's implied move today is for 0.66% or 81-pips; GBP/USD's is for 0.69% or 96-pips; USD/JPY's is for 0.76% or 81-pips; and Gold's is for 0.92%, or $10.93. Traders are clearly heading into the Powell testimony today with low expectations for anything significant at all to be revealed.

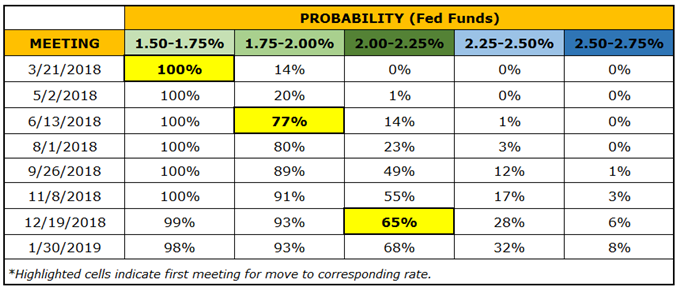

Table 1: Fed Funds Futures Implied Rate Path

As such, when the Powell testimony is released at 8:30 EST/13:30 GMT, and when he sits down in front of the House Financial Services Committee, we'll be keeping an eye on rates markets. For now, Fed funds futures are pricing in three rate hikes this year; should Powell offer up some more hawkish commentary, only then would we expect to see a significant reaction.

In the near-term, Powell is being framed as Yellen 2.0; expect talk of continuity of monetary policy and rate hikes proceeding at a gradual pace - essentially repeating what was said during the January FOMC meeting, as revealed in the minutes release last week.

Read more: FX Markets Eye Eurozone and US Inflation, US and Canadian GDP

In an environment where volatility has picked up, it is absolutely imperative that traders adjust their risk management perspective. If you haven't yet, it's the right time to review the Traits of Successful Traders series in order to become reacquainted with the tenets of risk management.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com.

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX.

To receive this analyst’s reports, sign up for his distribution list.

Don’t trade FX but want to learn more? Read the DailyFX Trading Guides.