- Silver price breakout stalls at uptrend resistance- rally vulnerable near-term

- Check out our 2019 projections in our Free DailyFX Top Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Silver prices have surged to levels not seen since January 2018 with the rally at risk near-term while below broader uptrend resistance. These are the updated targets and invalidation levels that matter on the XAG/USD charts heading into the close of the week. Review this week's Strategy Webinar for an in-depth breakdown of this silver price setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

Silver Price Chart – XAG/USD Daily

Chart Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Technical Outlook: In my last Silver Weekly Price Outlook we noted a long-bias on XAG/USD while above 1588 with above the 16.61/66 resistance hurdle targeting, “topside objectives at the June swing highs at 17.32 backed by the 50% retracement at 17.51.” Silver registered a high at 1750 early in the week before pulling back with the weekly opening-range still intact heading into Friday. Note that the upper parallel also converges on this range into the close of the week and further highlights its technical significance.

Key daily support now rests at the highlighted trendline confluence around 16.61 with broader bullish invalidation now at the February high / August open at 16.21/25. A topside breach / close above this threshold is needed to keep the long-bias viable targeting subsequent resistance objectives at 17.74 and 18.04.

Why does the average trader lose? Avoid these Mistakes in your trading

Silver Price Chart – XAG/USD 120min

Chart Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Notes: A closer look at silver price action shows XAG/USD reversing sharply from upper parallel of an ascending pitchfork formation extending off the late-June / July lows. We’re looking for a break of this single-day range (8/13) for guidance with the long-bias at risk near-term while below the trend resistance. Initial support rests with the ML / weekly open at 16.93-17 with a break below 16.51 needed to suggest a more significant high was registered on Tuesday.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: Silver prices are testing confluence uptrend resistance here and leaves the long-bias vulnerable while below the upper parallel. From a trading standpoint, a good place to reduce long-exposure / raise protective stops – be on the lookout for possible topside exhaustion on a retest of the highs. Ultimately a larger correction may offer more favorable entries closer to trend support.

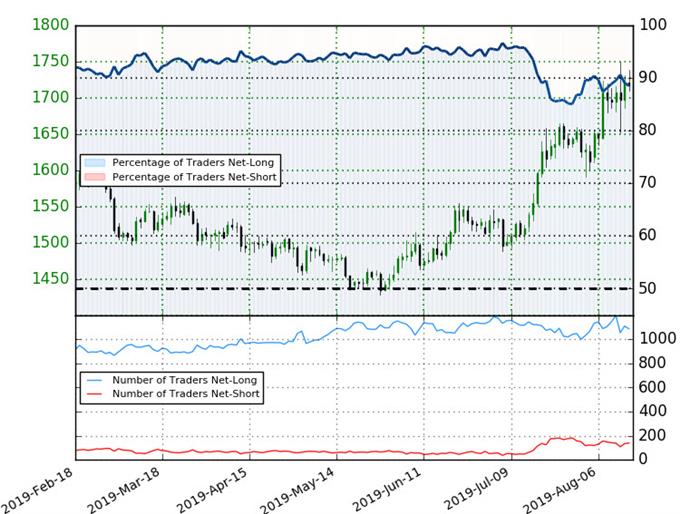

Silver Trader Sentiment (XAG/USD)

- A summary of IG Client Sentiment shows traders are net-long Silver - the ratio stands at +7.71 (88.5% of traders are long) – bearish reading

- Long positions are 5.6% lower than yesterday and 1.7% lower from last week

- Short positions are 18.5% higher than yesterday and 20.3% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Silver prices may continue to fall. Yet traders are less net-long than yesterday but more net-long from last week and the combination of current positioning and recent changes gives us a further mixed Spot Silver trading bias from a sentiment standpoint.

See how shifts in Silver retail positioning are impacting trend- Learn more about sentiment!

Active Trade Setups

- US Dollar Price Outlook: DXY Threatens Larger Recovery– Trade Targets

- Gold Price Targets: XAU/USD at Critical Resistance – Trade Outlook

- Euro Technical Price Outlook: EUR/USD Near-term Breakout Imminent

- Aussie Price Outlook: Is the Australian Dollar Recovery Real?

- Oil Price Outlook: Crude Spills into Support – WTI Trade Levels

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex