- USD/CHF price contracting around the yearly open- breakout to offer near-term guidance

- Check out our 2019 projections in our Free DailyFX USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The Swiss Franc has fallen more than 0.4% against the US Dollar since the start of the week with USD/CHF continuing to contract around the yearly open. These are the updated targets and invalidation levels that matter on the Swissy charts this week. Review this week’s Strategy Webinar for an in-depth breakdown of this trade setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

USD/CHF Price Chart - Swissy Daily

Technical Outlook: In my latest Swiss Franc Weekly Price Outlook we favored, “fading weakness sub-1.0091,” with, “immediate focus on the 9828/39 support confluence- look for a reaction there.” It’s been nearly seven weeks and price has continued to consolidate around this key level after registering a low at 9694 in late-June.

Daily support rests with the monthly open / 61.8% retracement at 97.90/92 backed by the low-day close / 78.6% retracement at 9749/55 – Ultimately a break / close below 9712/16 would be needed validate a break of the yearly opening-range. Initial resistance stands with the July trendline backed by 9907. A breach above 9965 would be needed to suggest a more significant low was registered last month.

Why does the average trader lose? Avoid these Mistakes in your trading

USD/CHF Price Chart – Swissy 120min

Notes: A closer look at Swissy price action shows USD/CHF trading within the confines of a downward sloping consolidation range off the monthly highs with the weekly opening-range straddling the yearly open at 9839 – look to the break for guidance.

Support rests with the lower parallel backed closely 9790/92 – look for a reaction there IF reached. A break lower exposes the 100% extension at 9773 backed by the uncovered gap at 9760- both regions of interest for downside exhaustion IF reached. A breach above 9873 would be needed to shift the focus higher towards 9901/07 and the 50% retracement of the yearly range at 9965.

Learn how to Trade with Confidence in our Free Trading Guide

Bottom line: Swissy has continued to narrow into the apex of this formation and the immediate focus is on a break of this range. From a trading standpoint, a break lower would have us targeting a drop towards 9760/73. Ultimately, we’ll favor fading a deeper pullback with a breach / close above 99 needed to fuel the next leg higher in price.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

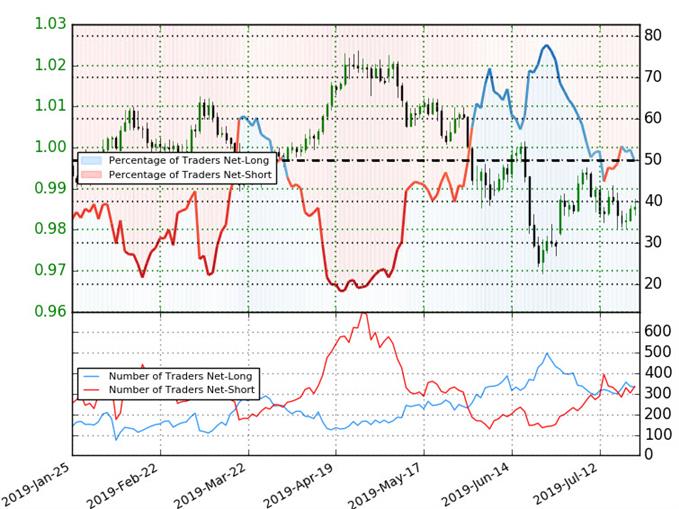

Siwssy Trader Sentiment - USD/CHF

- A summary of IG Client Sentiment shows traders are net-short USD/CHF - the ratio stands at -1.01 (49.7% of traders are long) – neutral reading

- Long positions are 1.5% lower than yesterday and 3.4% higher from last week

- Short positions are 7.7% higher than yesterday and 6.7% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CHF prices may continue to rise. Traders are further net-short than yesterday & last week, and the combination of current positioning and recent changes gives us a stronger USD/CHF-bullish contrarian trading bias from a sentiment standpoint.

See how shifts in USD/CHF retail positioning are impacting trend- Learn more about sentiment!

---

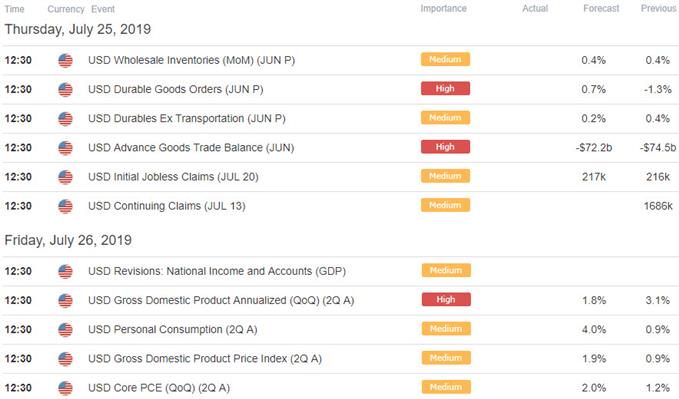

Relevant US / Swiss Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Trade Setups

- Gold Price Target Hit: XAU/USD Rally Vulnerable Near-term

- Canadian Dollar Price Chart: USD/CAD Breaks Out – Loonie Trade Levels

- Oil Price Chart: Crude Crushed Down to Support – WTI Trade Levels

- Sterling Price Chart: British Pound Testing Post-Brexit Support

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex