- Litecoin plummets after breaking support – initial downside targets in view

- Check out our 2018projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Litecoin is down nearly 60% year-to-date with prices approaching the yearly lows after breaking February trendline support earlier this week. The decline is approaching initial areas of support that could offer a reprieve. Here are the key levels that matter for LTC/USD.

New to Trading? Get started with this Free Beginners Guide

Litecoin Daily Price Chart (LTC/USD - Log)

Notes: Litecoin prices have more than 20% since the start of June with the decline now eyeing confluence support here around ~89.23. This region is defined by near-term channel support (red), the lower parallel of the broader pitchfork (blue) and the September high-day close. Note that a longer-term trendline extending off the June lows comes in just lower and IF prices are going to see any relief, this would be the first spot to look.

Initial resistance stands with the 50-line around 101/02 with broader bearish invalidation at the monthly open at 118. A break lower from here targets the 11/29 swing low / 88.6% retracement at 76/78 – look for a stronger reaction there.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: The momentum profile and broader price action suggests further losses in store for Litecoin. That said, this is the first are of interruption which limit losses near-term. From a trading standpoint, a good area to reduce short exposure with a rebound off this mark likely to offer more favorable short-entries while below the median-line. A break below 76 would likely see accelerate losses for the cryptocurrency with such a scenario risking a drop towards 54.26.

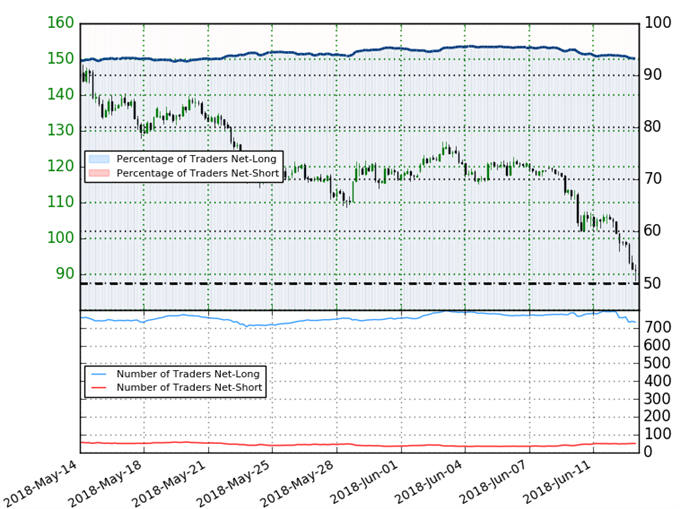

Litecoin IG Client Positioning (LTC/USD)

- A summary of IG Client Sentiment shows traders are net-long LTC/USD- the ratio stands at +13.79 (93.2% of traders are long) – bearish reading

- Traders have remained net-long Litecoin since Dec 25th; price has moved 63.7% lower since then

- Long positions are 7.4% lower than yesterday and 5.2% lower from last week

- Short positions are 1.9% higher than yesterday and 43.2% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Litecoin prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week and the recent changes in sentiment warn that the current Litecoin price trend may soon reverse higher despite the fact traders remain net-long.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

Economic Calendar – for the latest economic developments and upcoming event risk

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com