- EUR/USD at risk for further losses- Decline to offer favorable long-entries

- Check out our 2018projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

EURUSD reversed off near-term resistance this week and we’ve been tracking the pullback in price as the pair approaches interim support. Price has continued to trade within the weekly opening-range but we’re looking for a possible breakdown lower before resumption of the broader up-trend.

EUR/USD Daily Price Chart

Technical Outlook: In this week’s EURUSD Technical Perspective I highlighted that, “Initial resistance stands with the 2018 high-day close at 1.2409 with key resistance steady at 1.2598 where the 2008 trendline resistance converges on the 61.8% retracement of the 2014 decline.” Price rallied into 1.2409 this week before reversing sharply and while the broader picture remains constructive, the pair remains vulnerable near-term while below this threshold.

New to Forex Trading? Get started with this Free Beginners Guide

EUR/USD 120min Price Chart

Notes: A closer look at EUR/USD price action shows the pair trading within the confines of a near-term descending pitchfork formation extending off the monthly highs. A break of the ascending formation we’ve been tracking since the start of the month keeps the risk lower while below 1.2352/60. Interim support rests at 1.2318/26 with a break lower targeting the weekly opening-range lows at 1.2291 backed by 1.2265 & 1.2240- both areas of interest for possible exhaustion / long-entries.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: EURUSD reversed from confluence resistance this week and while the immediate risk is lower, ultimately a more significant set-back should offer more favorable long entries near the median-line with a breach above near-term resistance once again targeting the high-day close backed by key resistance at 1.2452/61.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

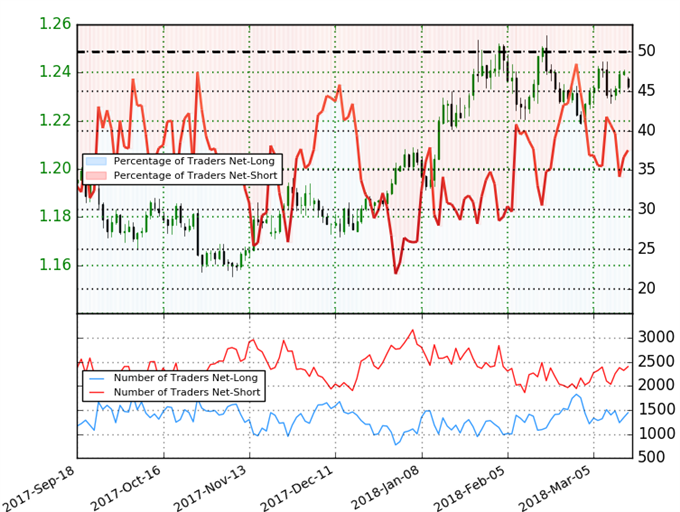

EUR/USD IG Client Sentiment

- A summary of IG Client Sentiment shows traders are net-short EURUSD- the ratio stands at -1.66 (37.5% of traders are long) – weak bullishreading

- Traders have remained net-short since Apr 18th; price has moved 16.9% higher since then

- Long positions are 4.0% higher than yesterday and 9.5% higher from last week

- Short positions are1.5% lower than yesterday and 6.1% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.

See how shifts in EUR/USD retail positioning are impacting trend- Learn more about sentiment!

---

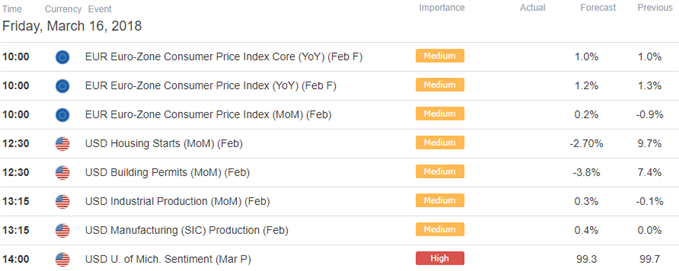

Relevant Data Releases

Other Setups in Play

- EUR/AUD Technical Outlook: Monthly Price Reversal Under Review

- BTC/USD Technical Outlook: Bitcoin Prices Vulnerable to Deeper Losses

- AUD/JPY Price Analysis: Yearly Low Exposed After Early-March Reversal

- Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly, please sign-upto his email distribution list

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com

http://forms.aweber.com/form/63/1731135063.htm