- LTC/USD breaches through February opening-range highs; constructive above 162

- Check out our 2018 quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Litecoin prices are on pace to post the largest single-day rally since the December record high with the advance breaking above the February opening-range. The rally is now testing near-term downtrend resistance and a breach here would be needed to validate a reversal of the multi-month downtrend.

Litecoin Daily Price Chart (Log)

Technical Outlook: Litecoin prices broke above the February opening range highs & monthly open resistance today with the rally now testing the upper median-line parallel of the descending pitchfork extending off the record highs. This threshold is backed closely by a Fibonacci confluence at 222/25- a close above this level is needed to validate a breakout of the broader descending formation with such a scenario targeting 260 and the 61.08% retracement at 298.

New to Forex Trading? Get started with this Free Beginners Guide

Litecoin 240min Price Chart (Log)

Notes: A closer look at Litecoin price action sees the cryptocurrency surging through the monthly highs with the advance now struggling at the upper median-line parallel. The technical outlook remains constructive while above the monthly open at 162 with a breach above 225 needed to fuel the next leg higher.

Why does the average trader lose? Avoid these Mistakes in your trading

Near-term bullish invalidation now raised to the yearly low-day close at 130- a break below this level would risk significant losses for Litecoin prices with such a scenario targeting a drop towards confluence support at 116 where the 200-day moving average converges on the 78.6% retracement and basic slope support. Bottom line: prices are testing downtrend resistance and we’re looking for a reaction. From a trading standpoint, I’ll favor longs while above the monthly open.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis mini-series

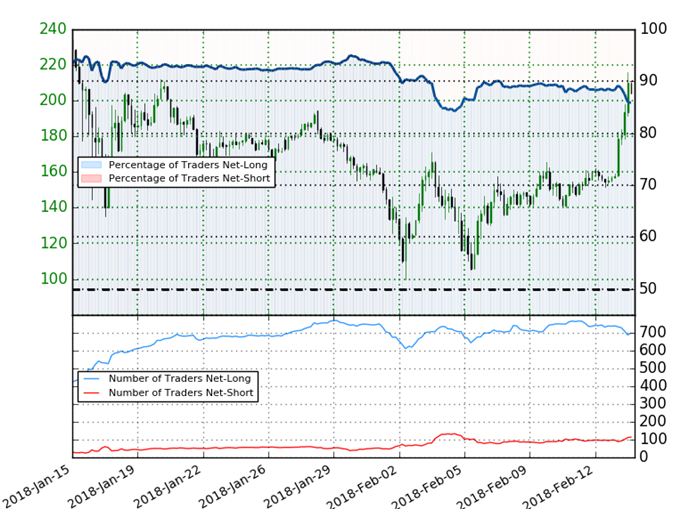

LTC/USD IG Client Sentiment

- A summary of IG Client Sentiment shows traders are net-long LTC/USD- the ratio stands at +6.06 (85.8% of traders are long) – bearishreading

- Traders have remained net-long since Dec 25th; price has moved 19.6% lower since then

- The percentage of traders net-long is now its lowest since Feb 7thwhen Litecoin traded near 136.42

- Long positions are 4.8% lower than yesterday and 1.7% lower from last week

- Short positions are18.6% higher than yesterday and 43.8% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Litecoin prices may continue to fall. However, traders are less net-long than yesterday and compared with last week and therecent changes in sentiment warn that the current Litecoin price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in LTC/USD retail positioning are impacting trend- Click here to learn more about sentiment!

---

Other Setups in Play

- Bitcoin Price Surges 57% off Monthly Lows- Bullish Breakout Potential

- USD/CAD Price Rally at Risk Ahead of Canada Employment

- GBP/USD Bears to Face BoE- Levels to Know for Super Thursday

- EUR/USD Down but Not Out as Prices Approach Bullish Trend Support

- Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly via email, please SIGN UP HERE

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com