To receive Michael’s analysis directly via email, please SIGN UP HERE

- Bitcoin prices respond to confluence resistance- pullback to offer favorable long-entries

- Check out our new 4Q projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

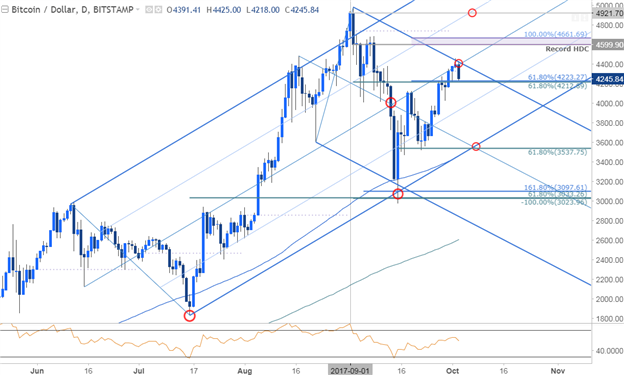

BTC/USD Daily Chart

Technical Outlook: Bitcoin prices responded to confluence resistance at the median-line of the broad ascending pitchfork formation we’ve been tracking off the July lows (around ~4410). The pullback is testing interim support at 4212/23 with our broader bullish invalidation level now raised to 3538 where a pair of parallels converge on the 61.8% retracement.

A breach higher from here targets key resistance at 4600/62- a region defined by the record high-day close and the 100% ext of the late-September advance. Subsequent topside objectives eyed at 4921. Bottom line: we’re at risk for a larger pullback if we break this support but the broader outlook remains constructive.

New to Forex? Get started with this Free Beginners Guide

BTC/USD 240min Chart

Notes:A close look at price action shows Bitcoin continuing to trade within the confines of a near-term ascending median-line formation (modified) with the lower parallel highlighting a key support confluence just lower at 4103. We’ll reserve this level as our near-term bullish invalidation level with a breach of the weekly opening range highs targeting 4550 backed by the 100% ext at 4665.

A break below this near-term formation risks a larger pullback with such a scenario eyeing 3887 backed by 3713 & 3538 – both level of interest for exhaustion / long-entries. From a trading standpoint, I’ll be looking to fade weakness into structural support.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

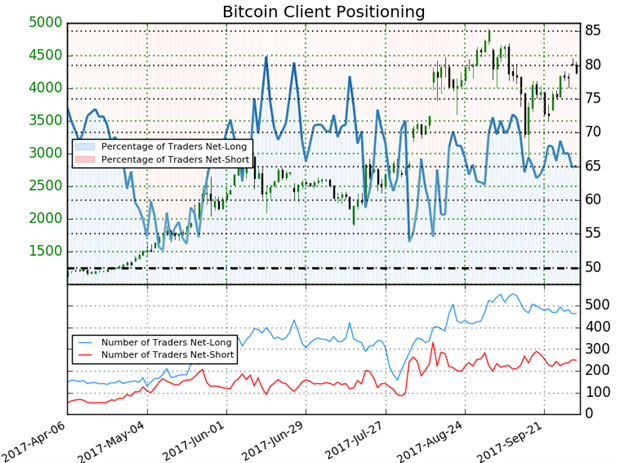

- A summary of IG Client Sentiment shows traders are net-long BTCUSD- the ratio stands at +1.86 (65.1% of traders are long) – bearishreading

- Long positions are 1.3% lower than yesterday and 0.9% lower from last week

- Short positions are 0.8% lower than yesterday but 6.9% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Bitcoin prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Bitcoin price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in Bitcoin retail positioning are impacting price trends- Click here to learn more about sentiment!

---

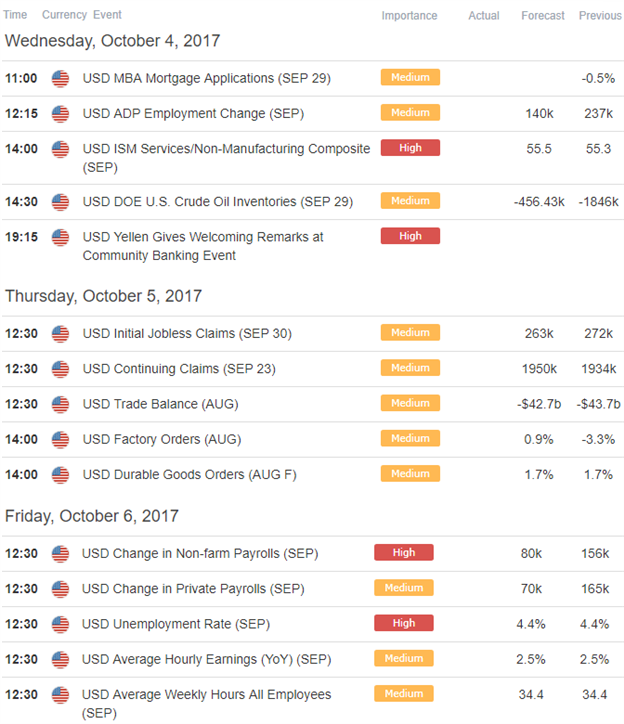

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play

- Weekly Technical Outlook: USD Majors, Cryptocurrencies in Focus

- Ethereum Prices Top 300- Will it Hold?

- USD/CAD Rally Eyes Key Resistance Targets

- AUD/USD Sell-Off Approaching Key Support Hurdle

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.