To receive Michael’s analysis directly via email, please SIGN UP HERE

- A breach of multi-year trendline takes GBPJPY to first major test of resistance

- Check out our quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook: GBPJPY broke above long-term trendline resistance extending off the 2015 highs this month with the advance now approaching the first major resistance hurdle just ahead of the 152-handle. This threshold is defined by the 38.2% retracement of the 2015 decline and converges on the upper parallel over the next few days.

New to Forex? Get started with this Free Beginners Guide

GBP/JPY 240min

Notes:A closer look at price action sees GBP/JPY trading within the confines of an ascending pitchfork formation extending off the June lows with the 50-line further highlighting this near-term resistance zone. Look for interim support at the 150-handle with our focus higher in the pair while above 148.43. A breach above the 152-figure keeps the long-bias in play targeting subsequent resistance objectives at the upper median-line parallel / 154.70.

A break below the May high-day close at 147.86 would be needed to suggest a deeper correction is underway with such a scenario targeting 146.71 & 145.45. Bottom line: the broader focus remains higher but look for a pullback to offer entries while above the median-line. Keep in mind that the breach made early this month is technically significant and suggests there’s lots of upside potential here- we’re simply at risk for a pullback and trying to gauge the depth of that pullback is always tricky- stay nimble.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

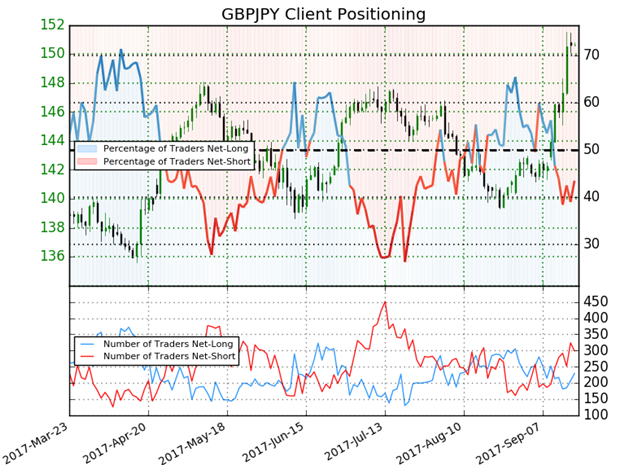

- A summary of IG Client Sentiment shows traders are net-long GBPJPY- the ratio stands at -1.3 (43.5% of traders are long) – weakbullishreading

- Long positions are 5.0% higher than yesterday and 16.1% lower from last week

- Short positions are 6.9% lower than yesterday and 53.3% higher from last week

- We typically take a contrarian view to crowd sentiment and the fact traders are net-short suggests GBPJPY prices may continue to rise. However, retail is less net-short than yesterday but more net-short from last week and the combination of current positioning and recent changes gives us a further mixed GBPJPY bias from a sentiment standpoint.

See how shifts in retail positioning are impacting trend- Click here to learn more about sentiment!

---

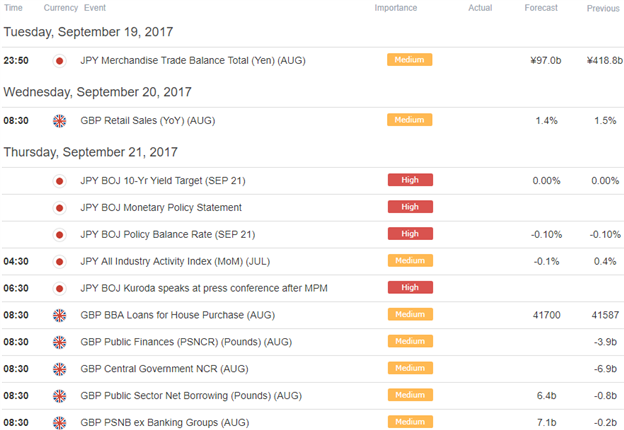

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play

- FX Markets Gear Up for FOMC; USD Hangs by a Thread

- Bitcoin Prices Continue to Bleed- Levels to Know as Crypto Collapses

- Ethereum Prices Search for Support as Adoption Doubts Intensify

- EUR/USD Battle Lines Drawn

- A Weekly Technical Perspective for USD Majors

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.