Talking Points

- USD/JPY at near-term resistance ahead of key U.S. data

- Updated targets & invalidation levels

USDJPY 120min

Chart Created Using TradingView

Technical Outlook: Last week I highlighted a near-term consolidation structure heading into Jackson Hole with while noting that the, “trade has become increasingly one sided and from a trading standpoint, I would be looking for a washout to the downside before inevitably reversing higher.” Well Yellen did not disappoint with a brief break below the formation reversing sharply through trendline resistance.

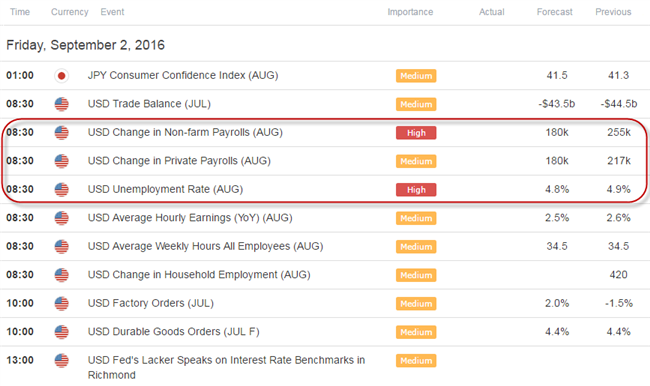

We’ve been tracking this setup on SB Trade Desk all week – the advance responded to confluence resistance in early New York trade today with the pullback now sitting on the 61.8% median-line parallel. Heading into tomorrow’s U.S. Non-Farm Payrolls release, the trade remains constructive while above the weekly open at 102.05 with a break below the weekly opening-range low / 101.76 needed to shift the focus back to the short-side.

A breach above this key resistance region targets subsequent topside objectives at 104.47, 104.92 & 105.80. From a trading standpoint, I would be looking for a washout lower on the release to possibly offer favorable entries near structural support. If the pair just breaks higher from here, a fade opportunity may present itself on an exhaustion run into 105. For the complete setup and to continue tracking this trade & more throughout the week- Subscribe to SB Trade Desk.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

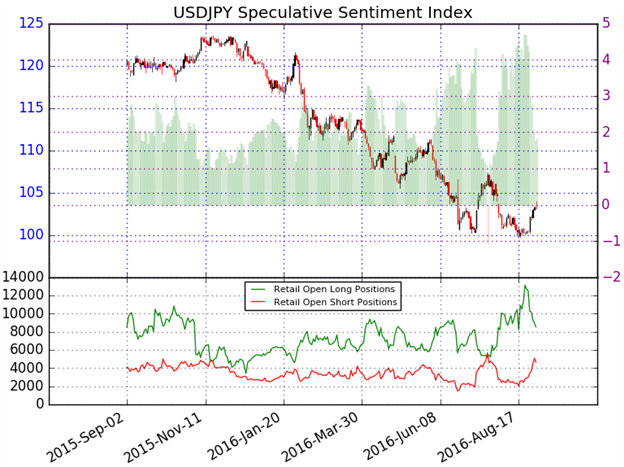

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net long USDJPY- the ratio stands at 1.82 (65% of traders are long)- weak bearish reading

- Long positions are 5.0% lower than yesterday and 32.5% below levels seen last week while Short positions jumped 58.0% during the same time period. .

- Open interest is 5.9% lower than yesterday and 1.3% above its monthly average

- Despite the fact that SSI remains net long, the shift in positioning this week suggests traders may be trying to fade this advance and leaves the pair vulnerable for a breakout heading into the start of September trade.

- Note that the last time we USDJPY SSI turned negative was the day before the July peak.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Relevant Data Releases This Week

Other Setups in Play:

- AUDUSD Searches for Support as NFPs Take Center Stage

- USDCAD Rally to Face Canada GDP- Support at 1.2965

- GBPJPY at Key Resistance Hurdle Ahead of UK Mortgages- 133.14 Support

- Webinar: Post-Yellen USD Advance at Risk into Monthly Close / NFP

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)