Talking Points

- GBP/JPY within well-defined ascending channel ahead of UK data

- Updated targets & invalidation levels

GBPJPY 120min

Chart Created Using TradingView

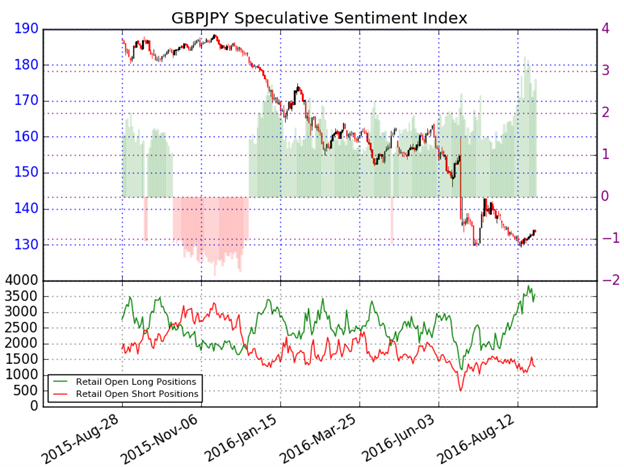

Technical Outlook: UK mortgage applications are on tap tomorrow with consensus estimates calling for a slowdown to an annualized 61.9K which would be the lowest since March of 2015. Heading into the release, GBPJPY is trading within the confines of an ascending channel formation off the monthly lows with the pair testing a key near-term Fibonacci confluence at 134.45/48 last night.

From a trading standpoint, the trade remains constructive while above confluence support at 133.14 where channel support converges on a basic 23.6% retracement of the advance off the lows. We’ll reserve this zone as our near-term bullish invalidation level with a breach above key resistance targeting subsequent topside objectives at the monthly open (135.38) and the 50% retracement / channel resistance at 136.15.

A break below support shifts the focus towards 132.35, 131.73 & 131.10. Key support & broader bullish invalidation rests lower at 130.82/96 – a region defined by the 2016 low-day close & the August 19th uncovered close. For the complete setup and to continue tracking this trade & more throughout the week- Subscribe to SB Trade Desk.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net long GBPJPY- the ratio stands at +2.8 (74% of traders are long)- bearish reading

- Short positions are 4.0% higher than yesterday and 18.9% above levels seen last week.

- Open interest is 3.5% higher than yesterday and 10.6% above its monthly average.

- Current retail positioning keeps the broader outlook weighted to the downside, but there appears to be an adjustment going into the end of the month as the SSI comes off of the 2016 extreme.

- The recent move in SSI is not only accompanied by a material uptick in short positions, but long positions have marginally increased during the same period with open interest 10.6% above the monthly average.

- With that said, month-end rebalancing may impact market participation going into September, but a narrowing in retail sentiment may coincide with a larger rebound in GBP/JPY.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

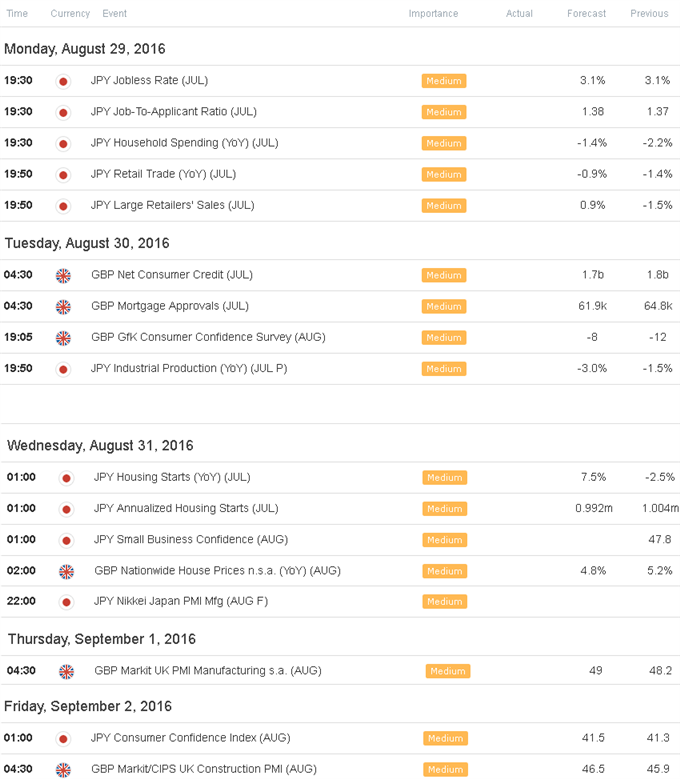

Relevant Data Releases This Week

Other Setups in Play:

- Webinar: Post-Yellen USD Advance at Risk into Monthly Close / NFP

- USDJPY: US GDP / Yellen Speech to Trigger Consolidation Range-Break

- EURUSD: Waiting for the Dip & Rip- Key Resistance at 1.1400

- Webinar: Sterling Crosses On the Offensive- Yellen to Steer the Dollar

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)