Talking Points

- GBP/USD turns from Fibonacci support ahead of UK jobs data

- Updated targets & invalidation levels

GBPUSD 120min

Chart Created Using TradingView

Technical Outlook: Sterling is trading within the confines of a descending pitchfork formation with the exchange rate rebounding off the 88.6% retracement of the post-Brexit advance last night. The focus is on initial resistance at 1.3056 with a breach above the upper parallel / 1.3100 needed to validate a near-term reversal in the pair.

Interim support rests with the weekly open / low-day close at 1.2921/26 with a break below 1.2870 needed to shift the focus back to the short-side. A breakout of this formation targets subsequent topside objectives at 1.3173 & the 61.8% retracement / monthly open at 1.3238/46.

From a trading standpoint, I would be looking to fade weakness while above 1.2950 near-term - we'll have to asses how the pair reacts on a move into the 1.31-handle. For the complete setup and to continue tracking this trade& more throughout the week- Subscribe to SB Trade Deskand take advantage of the DailyFX New Subscriber Discount.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

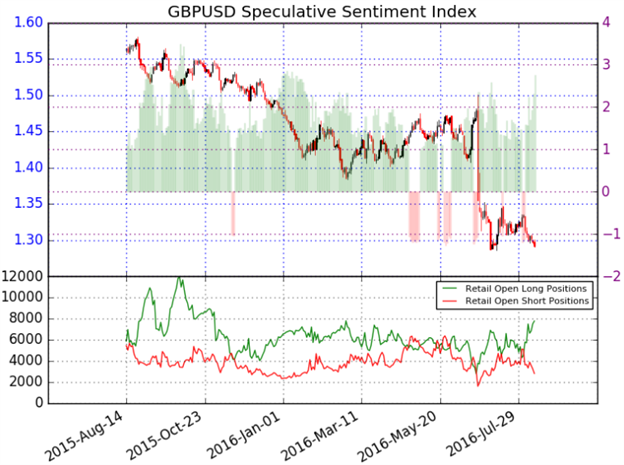

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net long GBPUSD- the ratio stands at +2.76(73% of traders are long)-bearishreading

- Yesterday the ratio was +2.34. Long positions are 4.1% higher than yesterday and 36.4% above levels seen last week.

- Open interest is 0.5% lower than yesterday but 10.1% above its monthly average.

- While this would normally be interpreted as a bearish reading, it’s important to note that SSI is approaching post-Brexit extremes and is likely to see limited downside near-term. That said, a pullback off SSI extremes alongside a breach above 1.31 would suggest a larger-scale recovery is underway.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

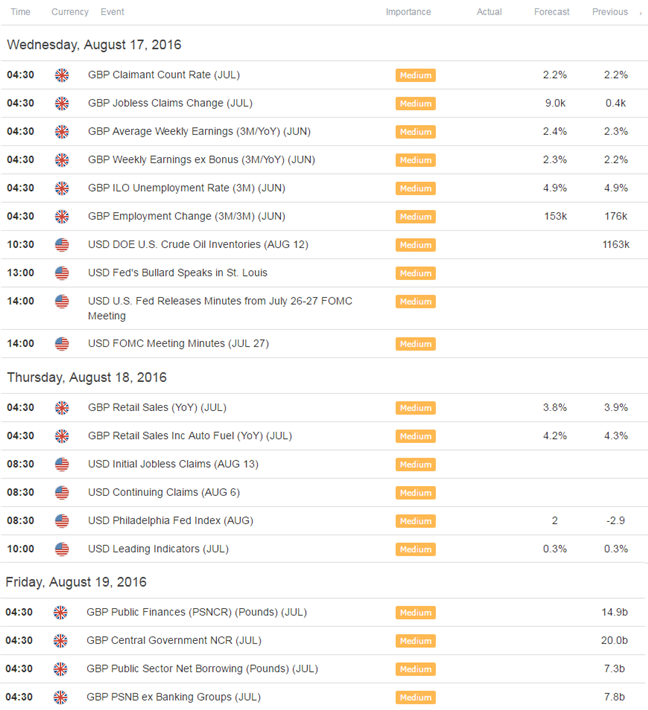

Relevant Data Releases This Week

Other Setups in Play:

- NZD/USD Advance Eyes Key Hurdle at 7300 Ahead of Labor Report

- EUR/USD: Respect this Slope Ahead of Upcoming Data- SSI Points Higher

- Webinar: USD Crosses in Focus- Levels to Know Ahead of CPI

- USD/JPY Range at Risk as Retail FX Sentiment Comes Off Extremes

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)