Talking Points

- USD/JPY near-term technicals keep focus higher into U.S. Retail Sales

- Updated targets & invalidation levels

USDJPY 120min

Chart Created Using TradingView

Technical Outlook: I highlighted this setup yesterday on my analyst pick – It’s too soon to tell, but a newly identified median-line off the lows could be in play here. Focus remains unchanged, “expect to see some consolidation but broadly looking for a break of the monthly opening-range, which as of now consists of the 8/2 daily candle (100.68 – 102.83/94).”Initial resistance is eyed at the monthly open 102.28 with a breach above median-line resistance around ~103.55 needed to validate a more significant reversal in the pair. Subsequent resistance objectives eyed at 104.09/17 & 104.89.

Key support & bullish invalidation stands with the July low-day close at 100.57 with a break below this level risking a decline towards support targets at the July low at 99.99 & the Brexit lows at 98.79. From a trading standpoint, heading into the release I would be looking to fade weakness while within this near-term formation. For the complete setup and to continue tracking this trade& more throughout the week- Subscribe to SB Trade Deskand take advantage of the DailyFX New Subscriber Discount.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net long USDJPY- the ratio stands at +3.85(79% of traders are long)-bearishreading

- Yesterday the ratio was +3.89. Long positions are 3.8% lower than yesterday and 6.0% below levels seen last week

- Open interest is 3.6% lower than yesterday and 8.9% above its monthly average

- Nothing new to add beyond yesterday’s observations- Risk remains for a rebound higher as SSI comes off recent extremes- “Keep in mind that SSI stretched into an extreme read of +4.5 as USDJPY rebounded off the August low. The last time SSI was at this extreme was on 7/8, which marked the 2016 low-close. From a trading standpoint, I would be looking to fade weakness into structural support.”

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

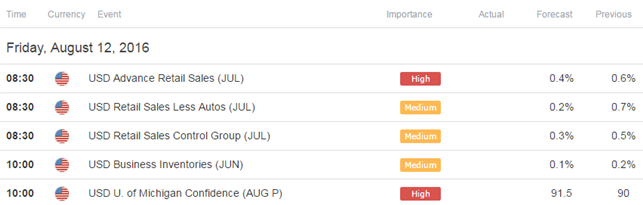

Relevant Data Releases This Week

Other Setups in Play:

- AUD/NZD Snaps Back from Slope Support Ahead of Retail Sales

- NZD/USD to Face-Off as Wheeler Deals Rate Cut

- USDCAD Advance Vulnerable Sub 1.3186 - Look Lower to Get Long

- EUR/USD Susceptible to NFP Pullback- Constructive Above 1.1060

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)