Talking Points

- EURAUDtesting key near-term support- longs scalps favored above 1.5830

- Updated targets & invalidation levels

- Event Risk on Tap This Week

EURAUD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

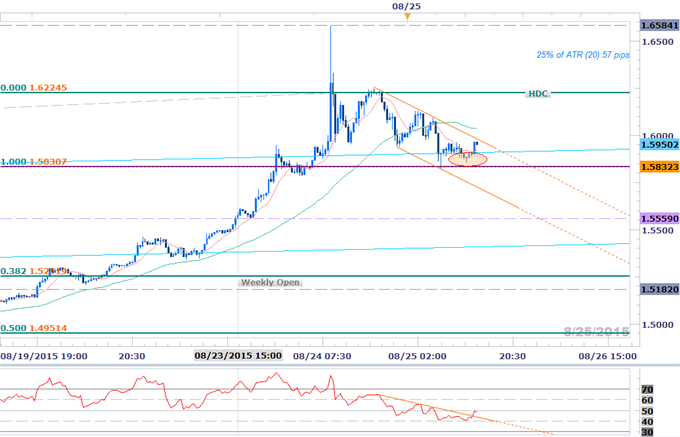

- EURAUD breakout rally reverses at upper median line parallel resistance

- Pullback now testing initial support confluence at 1.5830 (near-term bullish invalidation)

- Interim resistance at the high-day close- 1.6225 backed by 1.6584

- Support break targets confluence at the opening range low 1.5569

- Critical support confluence & broader bullish invalidation at highlighted region ~1.5365

- Momentum breaches 70 for the first time since December- constructive

- Limited event risk into end of week

EURAUD 30min

Notes:EURAUD reversed off slope resistance on Monday with the decline now coming into key near-term support at the confluence of the 2014 high and the former upper median-line parallel extending off the April high. We’ll reserve this region as our near-term bullish invalidation level with a break below risking sharper declines towards the weekly open / opening range low at 1.5559.

Bottom line: we’ll be looking for a resolution to the 1.5832 – 1.6225 range with a constructive outlook above support. Resistance stands at the high-day close at 1.6225 with a breach targeting the upper median-line parallel / stretch highs at 1.6584. Keep in mind the pair has seen an uptick in its daily average range with a quarter of the daily ATR yielding profit targets of 55-58 pips per scalp. Event risk is rather limited heading into the end of the week so we’ll be watching for further developments out of China alongside recent dovish rhetoric coming out of ECB members ahead of the September 3rd interest rate decision.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases

Other Setups in Play:

- Webinar: Global Equity Rout Fuels Massive Spike in FX Volatility

- AUDNZD Free Falls into the August Open- Bearish Sub 1.1175

- EURUSD Surges to Fresh Weekly High on FOMC Leak- Long Scalps Favored

- Scalping NZDUSD Opening Range- 6630 Resistance Remains Key Hurdle

- Webinar: USD Scalps Hinge on CPI- Setups in Play this Week

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex,contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video