CRUDE OIL OUTLOOK:

- Crude oil prices mostly ignoring Fed-themed macro, supply/demand gaps in focus

- Pullback possible amid risk-off trade but lasting bearish progress may be difficult

- Breaking key resistance below $93/bbl might expose the coveted $100/bbl figure

Crude oil prices have seemingly paid little heed to macro forces recently. Instead, the focus has been on a supply/demand imbalance that saw global output fall short of consumption by an average of 1.4 million barrels per day last year. That has brought cumulative international inventories to the lowest in seven years.

The WTI benchmark had another spirited intraday rally arrested Friday as blowout US jobs data stoked Fed rate hike speculation and drove up the US Dollar, but a downward reversal was tellingly absent. Prices are denominated in USD terms on world markets, so the currency’s rise applies de-facto pressure.

Looking ahead, a bit of re-engagement with broader sentiment trends in the absence of anything notable on the economic calendar seems to be afoot. WTI is edging lower alongside bellwether S&P 500 futures, suggesting that a risk-off tilt may translate into a pullback. The case for follow-through seems suspect for now however.

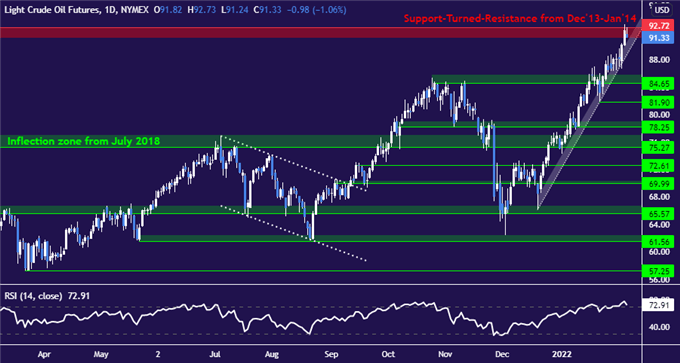

CRUDE OIL TECHNICAL ANALYSIS

Prices are testing resistance capped at 92.72, a barrier dating back 8 years. Breaking above it on a daily closing basis looks likely to set the stage for a test of the coveted $100/bbl figure. Initial support is anchored at 84.65, with sellers probably eyeing the swing bottom at 81.90 thereafter.

Crude oil price chart created using TradingView

CRUDE OIL TRADING RESOURCES

- What is your trading personality? Take our quiz to find out

- See our guide to build confidence in your trading strategy

- Join a free live webinar and have your questions answered

--- Written by Ilya Spivak, Head Strategist, APAC for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter