CRUDE OIL OUTLOOK:

- Crude oil prices seem biased lower in risk-off trade

- US PMI survey, API inventory flow figures in focus

- Key three-year chart barrier pressured once again

Crude oil prices have paused to digest losses after dropping to the lowest level in nearly two months. A risk-off backdrop might somewhat bias the scales in sellers’ favor. The WTI contract is pressuring the bottom of its three-day range having slumped along side S&P 500 futures in Asia-Pacific trade.

November’s US Manufacturing PMI data is in focus ahead. It is expected to show that activity growth accelerated from October, breaking a three-month losing streak despite gaps in global supply chains. The private-sector API estimate of weekly inventory flows is also on tap.

The latter will be judged against bets on a 1.47-million-barrel draw expected in official EIA statistics due on the following day. The former may have scope for an upside surprise. Data from Citigroup shows that recent news-flow has tended to outperform relative to baseline forecasts.

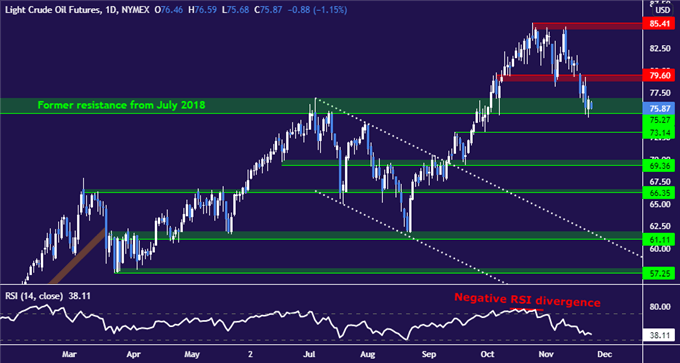

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are retesting a three-year resistance-turned-support level anchored at 75.27. Breaking below this barrier – with confirmation on a daily closing basis – may set the stage for a test of the $70/bbl figure, with perhaps a bit of friction near 73.14 along the way.

Immediate resistance is capped at 79.60, the upper bound of a former support shelf. Reclaiming a foothold back above that might translate into enough momentum to pressure the swing high at 85.41 once again.

Crude oil price chart created using TradingView

CRUDE OIL TRADING RESOURCES

- What is your trading personality? Take our quiz to find out

- See our guide to build confidence in your trading strategy

- Join a free live webinar and have your questions answered

--- Written by Ilya Spivak, Head Strategist, APAC for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter