CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices edge up on US fiscal stimulus hopes, upbeat data flow

- Soundbites from Washington DC, US PMI surveys now in the spotlight

- Gold prices down as US Dollar gains alongside Treasury bond yields

Crude oil prices managed to retrace some lost ground Thursday after the prior day’s selloff, the largest one-day loss in over a week, as an improvement in market-wide risk appetite helped buoy sentiment-geared assets. Tellingly, the WTI benchmark tracked higher alongside bellwether S&P 500 futures.

Markets seemed to be cheered by the appearance of a positive turn in US fiscal stimulus negotiations after House Speaker Nancy Pelosi said a deal is “just about there”. Data flow was also supportive: existing home sales surged to a 14-year high while jobless claims registered lower than expected.

Gold prices fell as the chipper mood buoyed Treasury bond yields, tarnishing the appeal of non-interest-bearing alternatives. Interestingly, the US Dollar managed to shed the anti-risk trading profile defining recent price action and rose in tandem, hinting the day’s new-flow may have curbed Fed easing bets.

CRUDE OIL, GOLD PRICES EYE US FISCAL STIMULUS AND PMI DATA

Soundbites shaping fiscal stimulus expectations are likely to remain in focus through the end of the trading week. Flash US PMI surveys headline the data docket, with forecasts pointing to a slight pickup in the overall pace of economic activity growth in October compared with the prior month.

A brighter view of the near-term business cycle might keep crude oil prices supported in the near term. A lasting rally seems unlikely however as weak demand continues to weigh. In fact, an EIA implied demand gauge published this week slumped toward Covid outbreak lows registered in April.

Gold may continue to suffer if yesterday’s trade dynamics remain in play, with hopes for a strengthening recovery boosting yields alongside the Greenback. However, disappointing data flow or souring stimulus prospects in the face of opposition in the Republican-controlled Senate might buoy the yellow metal.

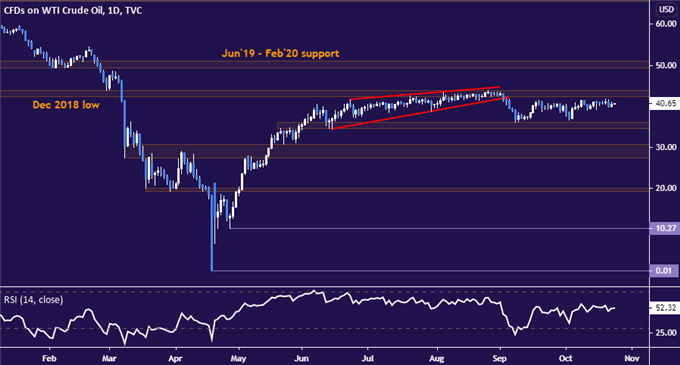

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are hovering just below range resistance in the 42.40-43.88 area. A downswing from here sees initial support in the 34.64-36.15 zone, with a break below that likely exposing the 27.40-30.73 region next. Alternatively, a daily close above resistance may open the door for a test of the $50/bbl figure.

Crude oil price chart created using TradingView

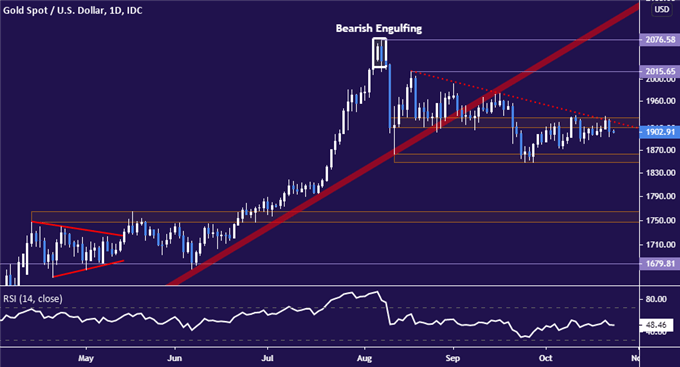

GOLD TECHNICAL ANALYSIS

Gold prices recoiled from resistance in the 1911.44-28.82 area, marked by a former range bottom and a falling trend line set from mid-August. Support is eyed in the 1848.66-63.27 zone, with a daily close below that seemingly setting the stage for a move below the $1800/oz figure. Alternatively, claiming a foothold above resistance may be followed by another test above $2000/oz.

Gold price chart created using TradingView

COMMODITY TRADING RESOURCES

- See our free guide on the drivers of crude oil price trends

- What is your trading personality? Take our quiz to find out

- Join a free live webinar and have your questions answered

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter