Crude Oil Prices, Gold Price Outlook – TALKING POINTS

- Gold prices may get another lift if more US data misses estimates

- Amplification of easing bets may boost appeal of anti-fiat assets

- Crude oil prices may succumb to growth fears over political risks

Learn how to use political-risk analysis in your trading strategy !

Crude oil prices fell after US ISM manufacturing data came in at its lowest point in a decade and led the S&P 500 ending the day in red. Gold prices rose alongside Fed rate cut bets as overnight index swaps jumped from 39 percent to an over-60 percent chance of a 25bp cut by the October 30 FOMC meeting. This partially helped buoy the yellow metal amid an ethereal détente in US-China trade relations which reduced easing expectations.

However, it is unclear how much longer gold will be able to rally on this report, with eyes now turning to mortgage and employment change data. If the reports follow in the same footsteps as the recent manufacturing data, gold prices could experience a modest boost if it amplifies Fed rate cut bets. Traders will also be watching commentary from regional Fed Presidents Thomas Barkin (Richmond), Patrick Harker (Philadelphia) and John Williams (New York).

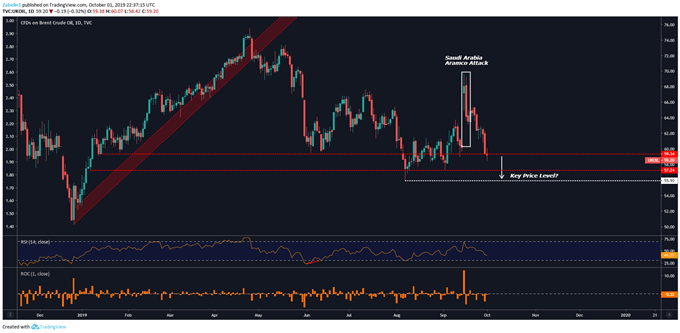

Crude oil prices will also be eyeing critical US data and its impact on overall market sentiment. Geopolitical risks in the Middle East continue to provide support to Brent, though the potency of these supply-disruption fears appears to be waning. The narrative of slower growth – underpinned by dismal economic data – will likely overwhelm crude oil prices unless an Aramco-level attack occurs again and jolts the commodity.

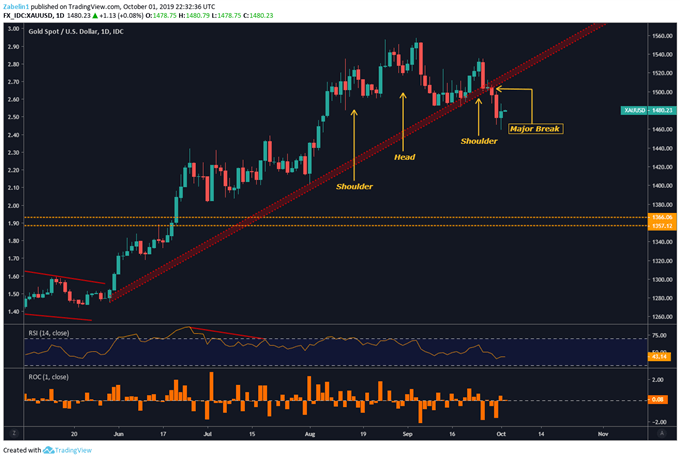

Gold Prices Outlook

Gold appears to have completed a bearish Head and Shoulders pattern and has broken through a five-month rising support channel and is now hovering around the 1470’s range, a level not reached since early August. Looking ahead, the yellow metal might attempt a modest rebound and test possible resistance at 1486.

Gold Prices Break Key Trend Line

Gold chart created using TradingView

Crude Oil Prices Technical Analysis

After spiking over 19 percent after the Saudi Aramco attack, crude oil prices have since pared all gains and are now hovering around $59/bbl. A break below with follow-through exposes the commodity to soft inter-range support at $57/bbl, with a critical floor at $55.90/bbl. A breach below this level would mark the lowest price of Brent since January 2019.

Will Crude Oil Prices Break Below 10-Month Low?

Crude oil prices chart created using TradingView

COMMODITY TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter