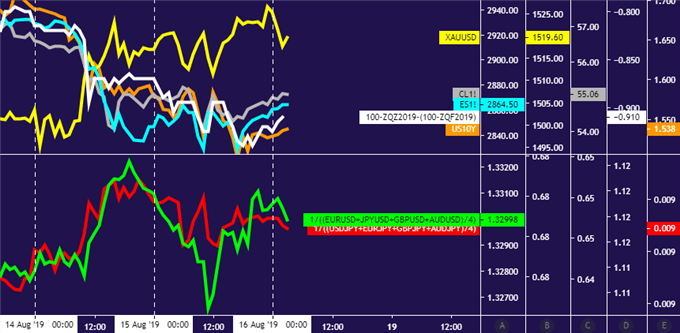

Crude oil, gold price performance chart created using TradingView

GOLD & CRUDE OIL TALKING POINTS:

- Gold prices may rise as markets tilt risk-off before the weekend

- Crude oil prices vulnerable, might move to retest $50/bbl figure

- Progress may be limited before FOMC minutes, Jackson Hole

Commodity prices idled Thursday as a lull in pace-setting news flow made room to digest recent volatility. From here, a relatively quiet offering on the economic data docket seems likely to keep broad-based market sentiment trends in control. The path of least resistance favors a risk-off scenario.

Sudden bursts of volatility have become increasingly common recently as prices react to eye-catching headlines from Washington and Beijing amid US-China trade war escalation. This probably has traders more leery than usual of holding pro-risk exposure over the weekend.

With that in mind, a round of defensive liquidation might pull down cycle-sensitive crude oil prices alongside stocks. A parallel dip in bond yields might have scope to push up gold, especially since the metal has managed gains even as the US Dollar trades higher recently.

Absent a burst of headline-driven volatility however, significant trend development seems unlikely. The week ahead brings critical inflection points in the Fed policy outlook – a defining macro input – by way of FOMC minutes and the Jackson Hole symposium. Commitment may be scarce in the interim.

Get our free guide to help build confidence in your gold and crude oil trading strategy !

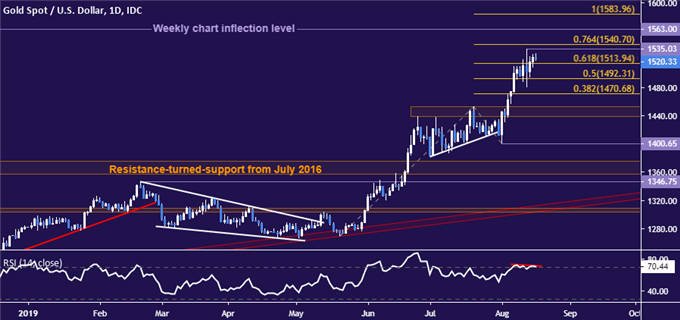

GOLD TECHNICAL ANALYSIS

Gold prices are inching toward resistance at 1540.70, the 76.4% Fibonacci expansion. A daily close above that exposes a weekly chart inflection level at 1563.00 next. Negative RSI divergence hints upside momentum is ebbing however. A turn below the 61.8% Fib at 1513.94 targets the 50% level at 1492.31.

Gold price chart created using TradingView

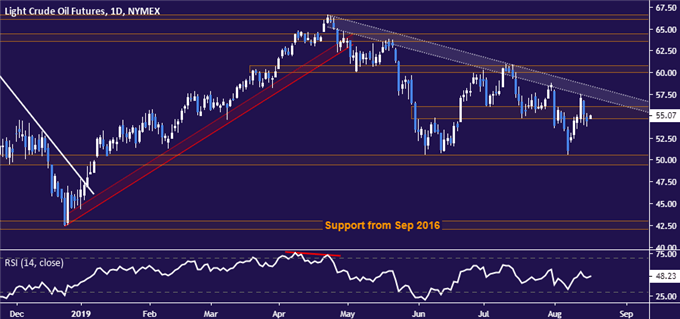

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices slipped back below the lower bound of the 54.72-56.09 congestion area, breaking the weekly uptrend in the process. Sellers may now move test the 49.41-50.60 zone anew. A daily close above trend resistance set from late April – now at 58.53 – seems necessary to neutralize downward pressure.

Crude oil price chart created using TradingView

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter