CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices edge up on upbeat US jobs data, but resistance holds

- Gold prices challenge trend support as Treasury yields, US Dollar rise

- Risk-off tilt hinted before Fed Chair Powell testimony, FOMC minutes

Crude oil prices rose as upbeat US jobs data buoyed demand hopes. The move conspicuously clashed with the response from broader risk sentiment trends. The bellwether S&P 500 stock index fell on the news (though the losses were later retraced) amid worries that the outcome might trim scope for Fed interest cuts.

In fact, the latter consideration meant that gold prices tracked lower as the figures crossed the wires, sending the US Dollar higher alongside benchmark Treasury bond yields. That tarnished the appeal of non-interest-bearing and anti-fiat assets epitomized by the yellow metal.

CRUDE OIL, GOLD PRICES MAY TRACK DIVERGENT PATHS IN RISK-OFF TRADE

A quiet start to an action-packed trading week may be ahead. A relatively lackluster data docket seems unlikely to inspire follow-through one way or another for marquee commodity prices as traders withhold conviction before testimony from Fed Chair Powell and the release of June FOMC minutes on Wednesday.

A risk-off tilt is hinted in futures tracking key Wall Street equities benchmarks however. That might cap yields and underpin gold prices, at least for now. Cycle-sensitive oil prices might meander lower in the meanwhile, though a breach of the prevailing near-term range probably has to wait.

Get the latest crude oil and gold forecasts to see what will drive prices in the third quarter!

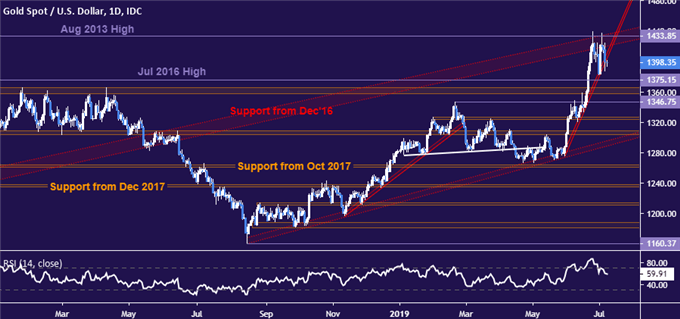

GOLD TECHNICAL ANALYSIS

Gold prices are pressuring trend line support guiding them higher since late May. A break below it opens the door to challenge a series of back to back resistance-turned-support levels running through 1346.75. Resistance remains at 1433.85, marked by the August 2013 top and the underside of support stretching back to December 2016. A breach above that targets north of the $1500 figure.

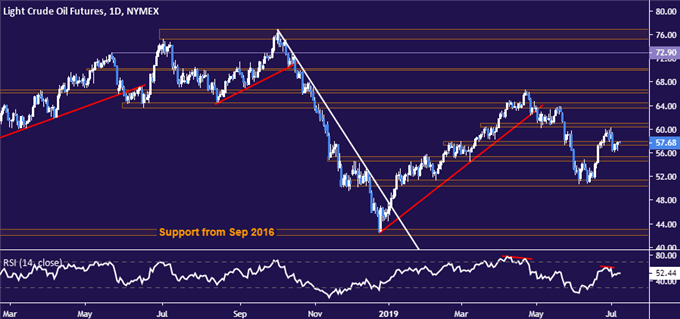

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are retesting support-turned-resistance at 57.88. A daily close above this barrier sets the stage to challenge the 60.39-95 zone anew. The lower bound of immediate support is at 54.55, with a breach below that targeting the 50.31-51.33 region thereafter.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter