GOLD & CRUDE OIL TALKING POINTS:

- Defensive shift in FOMC policy guidance may stoke global slowdown worries

- Gold prices may fall if Fed-inspired risk aversion boosts haven USD demand

- Crude oil prices may recoil from 11-month high if cycle-sensitive assets drop

Benchmark commodity prices were little-changed yesterday, with traders seemingly withholding directional commitment until the much-anticipated FOMC rate decision is released. No policy changes are expected. However, a palpably dovish turn in official rhetoric over recent months implies downgrades of growth and inflation forecasts as well as the projected policy path are almost certainly in the cards.

The markets’ priced-in outlook – as reflected in Fed Funds futures – argues for no rate hikes in 2019. Bringing official projections in line with that would imply a 50bps drop from December’s assessment, which is probably too drastic of an adjustment for slower-moving central bankers to make. Even that would only ratify existing positioning however, meaning a truly market-moving dovish surprise is unlikely.

Chair Powell and company’s defensive pivot may amplify already simmering global slowdown fears however. To the extent that this stokes de-risking across financial markets, it may hurt crude oil prices alongside other cycle-sensitive assets. It may likewise put a premium on the unrivaled liquidity of the US Dollar. A somewhat counter-intuitive rise on these grounds bodes ill for perennially anti-fiat gold prices.

Learn what other traders’ gold buy/sell decisions say about the price trend!

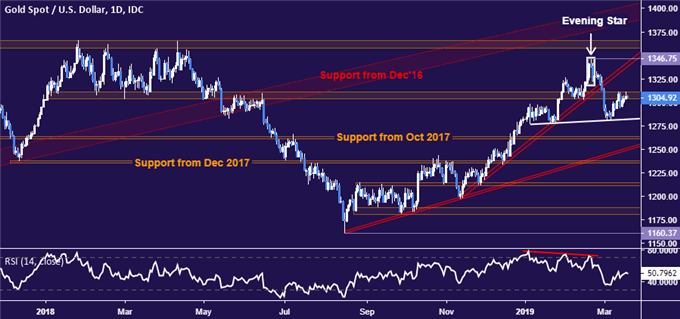

GOLD TECHNICAL ANALYSIS

Gold prices still look to be tracing out a somewhat awkward Head and Shoulders topping pattern. A daily close below neckline support at 1282.11 would initially expose the 1260.80-63.76 area but broadly hint at a larger drop to near 1220 thereafter. Alternatively, a breach of resistance in the 1303.70-10.95 zone sets the stage to revisit February’s swing high at 1346.75.

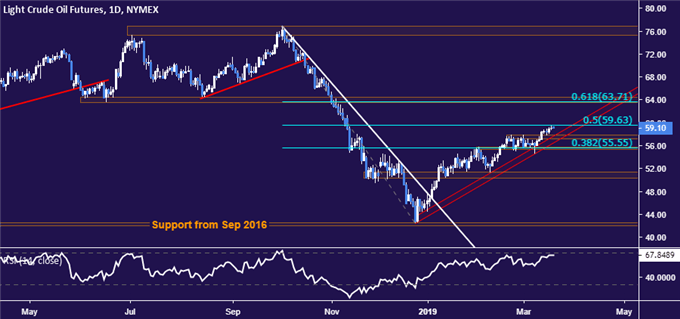

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are testing resistance marked by the 50% Fibonacci retracement at 59.63. A daily close above that opens the door for a test of former support in the 63.59-64.43 area, reinforced by the 61.8% Fib at 63.71. Any substantive reversal lower requires confirmation on a break below the 55.37-75 zone, which would mark invalidation of the uptrend from late December and expose the 50.31-51.33 region.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter