CRUDE OIL & GOLD TALKING POINTS:

- Gold prices locked in place as bond yields and US Dollar diverge

- Crude oil prices rise as EIA says inventories fell most in 6 weeks

- UofM US consumer confidence data may prove unusually potent

Gold prices failed to find fuel for a push higher in yesterday’s US Dollar pullback. The benchmark currency’s weakness appeared to reflect ebbing haven demand, tracking inversely of a parallel rise in stocks and bond yields. That left the non-interest-bearing yellow metal stuck, with the upshift in lending rates countervailing any upward momentum that might have come from anti-fiat demand.

Crude oil prices rose after DOE crude oil inventory data showed stockpiles shed 2.68 million barrels last week, topping forecasts calling for a 1.49-million-barrel drawdown. That marked the largest outflow in six weeks. Traders might have been primed for a smaller decline, amplifying upside momentum as markets repositioned. Tuesday’s leading API data foresaw a relatively meager draw of 560k barrels.

US CONSUMER CONFIDENCE DATA EYED AMID SHUTDOWN

Looking ahead, the University of Michigan gauge of US consumer confidence stands out on the economic calendar. With so many key statistical releases delayed by the US government shutdown, investors are almost certainly pining for any timely read on the precarious fundamental backdrop. A larger deterioration in sentiment than expected might touch off another risk-off sweep across financial markets.

Crude oil looks understandably vulnerable in such a scenario, with the WTI benchmark likely to succumb alongside other pro-cycle assets amid any significant bout of liquidation. As for gold, it might remain locked in place as yesterday’s trading patterns mark an about-face reversal. Indeed, risk aversion has scope to weigh on yields but also to encourage US Dollar gains.

Learn what other traders’ gold buy/sell decisions say about the price trend!

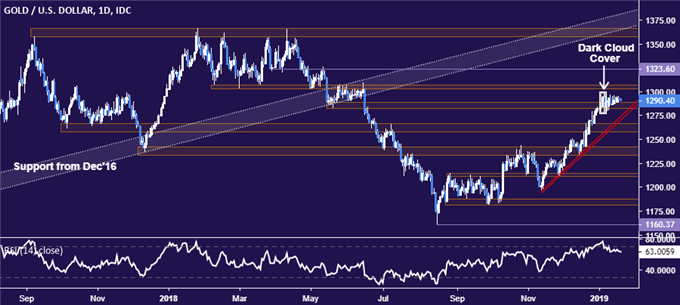

GOLD TECHNICAL ANALYSIS

Gold prices remain pinned below the $1300/oz figure, struggling to make good on a bearish Dark Cloud Cover candlestick pattern but likewise unable to mount a meaningful advance. Support is at 1282.27, with a breach below that targeting the 1257.60-66.44 area (former resistance, rising trend line). Alternatively, a move above resistance in the 1302.97-07.32 region sees a minor barrier at 1323.60, followed by the pivotal top in the 1357.50-66.06 zone.

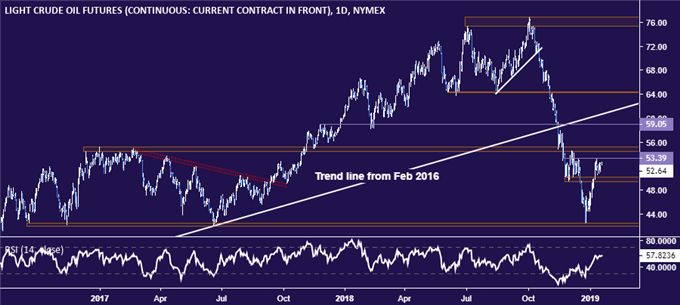

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices remain range-bound below minor resistance at 53.39. A break above this barrier confirmed on a daily closing basis exposes the 54.51-55.24 area. Rising past that puts 59.05 in focus. Alternatively, a move back below the 49.41-50.15 region sees the next layer of support in the 42.05-55 zone.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter