GOLD & CRUDE OIL TALKING POINTS:

- Gold prices may decline as the Fed disappoints hopes for dovish policy turn

- Crude oil prices fall with stocks for a third day, suffer worst loss in a month

- EIA inventory flow report may compound selling pressure facing oil prices

Gold prices edged up but struggled to make substantive progress as expected, with traders probably leery of committing one way or another before the FOMC rate decision. Deteriorating global growth expectations have markets pining for a dovish policy shift.

The markets’ baseline forecast for 2019 world GDP growth (as tracked by Bloomberg) has dropped to the lowest in a year. Against this backdrop, investors have aggressively cut back priced-in Fed rate hike bets. The likelihood of just one increase next year is not much better than a tossup at 56 percent.

Fed Chair Jerome Powell and company may be of another mind however. With CPI inflation registering on-trend at 2.2 percent, wage growth at a nine-year high of 3.1 percent and the jobless rate at the lowest in five decades, the US central bank may well opt to press on with stimulus withdrawal.

If official forecasts broadly endorse September’s view of 2-3 interest rate hikes in 2019 while a durable majority of policymakers continues to predict the so-called “neutral” Fed Funds rate at 3 percent, the US Dollar is likely to roar higher. Such a scenario bodes decidedly ill for the anti-fiat yellow metal.

CRUDE OIL MAY FALL FURTHER ON FED, EIA INVENTORY DATA

Worries about deteriorating global growth prospects have understandably weighed on cycle-sensitive crude oil prices. The WTI contract fell alongside US stocks for a third consecutive day yesterday, suffering the largest daily loss in a month.

A relatively hawkish Fed may compound selling pressure as risk aversion continues while USD gains put pressure on assets denominated in terms of the benchmark currency on global markets. The weekly set of EIA inventory flow figures may compound the down move.

Median forecasts suggest stockpiles shed 2.85 million barrels last week. An analogous estimate from API published yesterday offered a more pessimistic view however, showing a 3.45-million-barrel build. If official figures echo that result, the case for further weakness will be bolstered.

Learn what other traders’ gold buy/sell decisions say about the price trend!

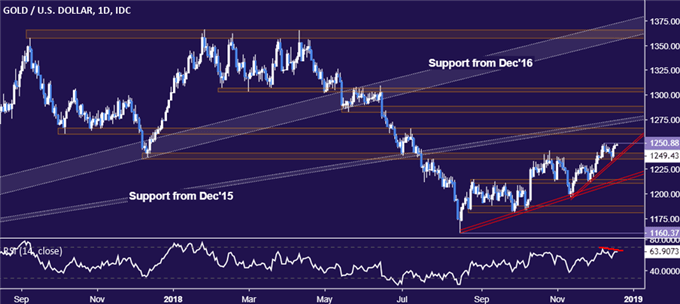

GOLD TECHNICAL ANALYSIS

Gold prices are hovering just below resistance marked by the December 10 high at 1250.88. A daily close above that initially exposes the 1260.80-66.44 area. Alternatively, a move below support in the 1235.24-41.64zone targets rising trend line support at 1211.05. Negative RSI divergence argues for a bearish scenario.

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices continued to sink, moving to challenge support marked by the August 2017 low at 45.62. A further breach below that exposes the 42.08-43.03 area. Near-term support-turned-resistance is at 49.44, the November 29 swing low.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter