CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices shed intraday gains on Trump-triggered risk aversion

- Gold prices edge down as US Dollar gains on haven flows, Italy turmoil

- European politics, EIA inventories and US CPI figures in focus ahead

Crude oil price action appeared to reflect swings in market-wide risk appetite yesterday, with the WTI contract echoing the intraday moves of futures tracking the bellwether S&P 500 index. That amounted to an early recovery that fizzled by day’s end, with a small loss registered by the close of trade in North America.

The reversal came after US President Donald Trump threatened a government shutdown unless funding is approved for the construction of a wall along the US’ southern border. Such a move is likely to weigh against US economic growth just as the markets grow increasingly worried about a global slowdown.

Investors’ concerns are understandable. Data from Citigroup shows global economic news-flow has increasingly deteriorated relative to forecasts while JP Morgan figures reveal slowing worldwide manufacturing- and service-sector activity growth since the beginning of the year.

Gold prices fell as the US Dollar continued to recover, hitting the highest level since April 2017 against its top counterparts. The move higher began alongside a rise in the Italy vs Germany 10-year yield spread amid lingering budget woes and continued courtesy of haven demand amid Trump-triggered risk aversion.

COMMODITIES WEIGH UP ITALY TURMOIL, EIA AND US CPI DATA

Looking ahead, November’s US CPI data is in focus on the data front. The core year-on-year inflation rate – the figure most relevant for Fed-watchers – is expected to register on-trend at 2.2 percent. That may encourage investors to rethink the recent dovish shift in policy bets, boosting the US Dollar.

Such an outcome is likely to bode ill for anti-fiat alternatives like gold as well as the spectrum of USD-denominated assets, including crude oil. European politics and EIA inventory flow data may limit scope for losses to some extent however.

In Europe, Italian Prime Minister Giuseppe Conte – arguably the most forthcoming of the key figures in Rome’s anti-establishment government – is due to meet with European Commission President Jean-Claude Juncker. Bond yields may drop amid risk aversion absent a budget breakthrough, boosting gold.

Meanwhile, EIA statistics may offer crude a helping hand if the outcome hews closely to API data showing stockpiles shed 10.2 million barrels last week. The median forecast from economists polled by Bloomberg calls for a far more modest 3.2-million-barrel drawdown.

See our guide to learn about the long-term forces driving crude oil prices !

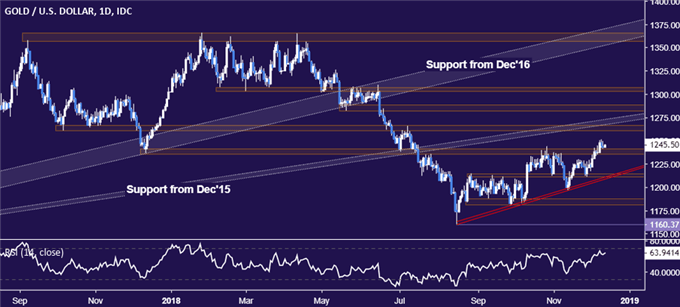

GOLD TECHNICAL ANALYSIS

Gold prices are marking time above resistance-turned-support in the 1235.24-41.64 area. Upward resumption from here sees the next upside barrier marked by former support levels capped at 1272.71. Alternatively, a move back below 1235.24 targets a rising trend line at 1208.81.

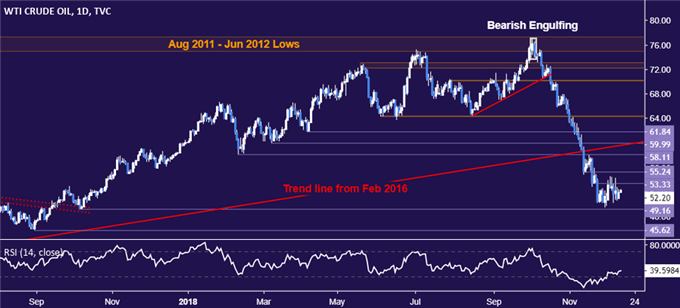

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices remain locked in a range between resistance at 53.33 (former support, falling trend line) and support at 49.16 (October 9, 2017 low). A break downward initially targets the August 31, 2017 bottom at 45.62. Alternatively, a daily close above the range top exposes support-turned-resistance at 55.24.

COMMODITY TRADING RESOURCES

- Learn what other traders’ gold buy/sell decisions say about the price trend

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter