Talking Points:

- Gold prices rise as Hurricane Harvey, North Korea sour market mood

- Crude oil prices drop as US refinery closures slow oversupply unwind

- US consumer confidence and API inventory flow figures on tap ahead

Gold prices rose as risk appetite soured, sending capital fleeing for the safety of Treasury bonds and pushing yields downward. The downbeat mood echoed in Fed rate hike bets, flattening the projected policy bath and sending the US Dollar lower. Taken together, it seems hardly surprising that this amounted to a supportive environment for anti-fiat and non-interest-bearing assets.

The risk-off move seemed to emanate from energy prices. Indeed, the opening drop on Wall Street coincided with a swoon in crude oil prices and energy shares suffered outsized losses as traders took stock of damage done by Hurricane Harvey. Analysts expect anywhere between 10-30 percent of US refining capacity to be derailed by the storm, which hurts the cause of drawing down the glut of raw-material supply.

Looking ahead, August’s US consumer confidence data headlines the data docket but the release may fall on deaf ears as risk trends remain at the forefront. Shares are taking a beating in Asia Pacific trade after North Korea fired a missile towards Japan. S&P 500 and FTSE 100 futures pointing to more of the same ahead. That may see gold continue higher.

Meanwhile, crude oil will look to API inventory flow data for a lifeline. Official EIA statistics due Wednesday are expected to show a 2.24 million barrel drawdown. The WTI benchmark may rise if the API report foreshadows a larger outflow, offsetting some Harvey-inspired negativity. Alternatively, signs of already slowing uptake before the storm made landfall would probably weigh heavily on prices.

Have a question about trading commodities? Join a Q&A webinar and ask it live!

GOLD TECHNICAL ANALYSIS – Gold prices punched sharply higher, finally clearing resistance in the 1295.46-97.95 area (double top, 23.6% Fibonacci expansion). From here, a daily close above the 50% level at 1323.25 exposes the 61.8% Fib at 1334.55. Alternatively, a reversal back below the 38.2% expansion at 1311.94 opens the door for a retest of 1297.95.

Chart created using TradingView

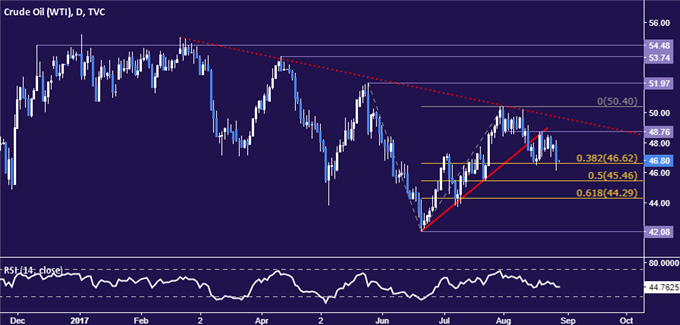

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices slumped back to range support marked by the 38.2% Fibonacci expansionat 46.62 but fell short of a confirmed breakdown. A daily close below this barrier exposes the 50% level at 45.46. Alternatively, a push above support-turned-resistance at 48.76 targets a falling trend line at 49.69, followed by theAugust 1 high at 50.40.

Chart created using TradingView

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak