Talking Points:

- Gold prices fall, crude oil gains with stocks amid risk appetite recovery

- Sentiment firmed as Deutsche Bank neared settlement with US regulators

- Commodities may fall if US ISM survey boosts Fed rate hike speculation

Gold prices declined after Agence France-Presse reported that Deutsche Bank (DB) is close to settlement on a $5.4 billion fine with the US Department of Justice (DOJ). Regulators initially sought $14 billion from the beleaguered lender to cover penalties linked to its MBS business in the run-up to the 2008-9 financial crisis. That fueled insolvency fears and sent jitters across the markets, with fears of a wobbly banking sector feeding demand for cash and alternative stores of value including the yellow metal.

Crude oil prices found support as Deutsche-linked optimism fueled a recovery in risk appetite across financial markets. Leading equity benchmarks as well as the WTI contract followed the firm’s shares upward as they opened for trade in Frankfurt and continued to pace the advance once US-listed equivalents came online.

The DB narrative may remain at the forefront for financial markets over the near-term as CEO John Cryan travels to the US to finalize negotiations. September’s ISM Manufacturing survey headlines the economic calendar, with consensus forecasts suggesting the US factory sector returned to growth after an unexpected contraction in August. An upbeat result that bolsters Fed rate hike speculation and boosts the US Dollar may broadly weigh against commodity prices.

What do crude oil and gold price patterns say about on-coming trends? Find out here !

GOLD TECHNICAL ANALYSIS – Gold prices fell for a fourth consecutive session, marking the longest losing streak in a month. A daily close below support in the 1303.62-08.00 area (May 2 high, 38.2% Fibonacci retracement) targets the 50% level at 1287.29. Alternatively, a reversal above falling trend line resistance at 1339.47 exposes a double top at 1367.15.

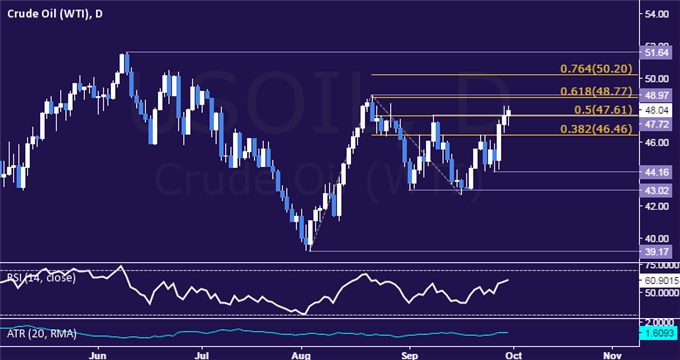

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices are aiming to test Augusts’ swing highs after securing a foothold above the $48/bbl figure. Breaking resistance in the 48.77-97 area (61.8% Fibonacci expansion, August 22 high) on a daily closing basis exposes the 76.4% level at 50.20. Alternatively, a reversal below the 50% Fib at 47.61 targets the 38.2% expansion at 46.46.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak