Talking Points:

- Gold prices (CFD: XAUUSD) show resilient as Fed deemed unlikely to start rate-hike cycle soon

- Crude Oil (CFD: USOil) prices battling with over-supply worries & retesting $40/bbl

- US Dollar as second strongest currency in G10 FX likely to impede commodity bloc for now

Commodity markets appear manic ahead of the hotly anticipated Bank of Japan meeting where many look to see if Abe’s promise of further easing will spur another round of elevated asset prices. On Wednesday, the Federal Reserve came away rather risk-Friendly as it appears we’re not about to see the start of a rate-hike cycle that many have feared post-QE.

Rising concern of over-supply in Oil is likely to weigh on economic cycle-sensitive crude oil prices. Meanwhile, gold prices are moving higher after the Federal Reserve talked up the economy more than future interest rates. Gold’s ~26% rise YTD looks comfortable following a gradual rise higher as the stage is still set for haven assets that perform well against possible inflation from seemingly endless QE-programs from various major Central Banks.

Where are gold and crude oil prices heading in the third quarter? See our forecasts here !

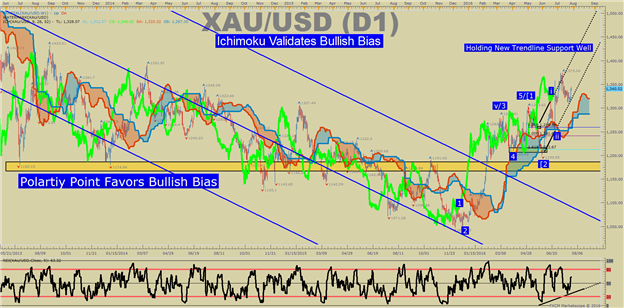

GOLD TECHNICAL ANALYSIS – Gold prices are sitting comfortably above the Ichimoku Cloud, and the trendline drawn off the June lows hinting a move higher may be ahead for the price of Gold. A daily close above 1,351 would signal a bullish resumption by trading above the R2 Weekly Pivot Level. Alternatively, a reversal below the weekly opening range low at 1313.30 targets the 50% threshold of the May-July range at 1287.30. The Relative Strength Index is also looking to favor further upside.

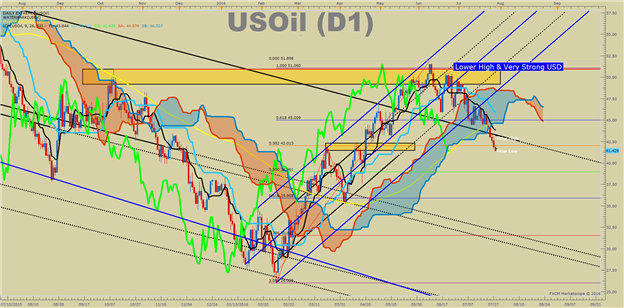

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices slumped back to levels not seen since April 20 when the price of Crude broke to 21-week highs. Now, fear of oversupply, and move back below the 100-DMA at $44.63/bbl will stoke fears of a possible sub-$40 trading level. Ichimoku is showing a breakdown with Price & Momentum (Bright Green Line) poking below the cloud on the daily chart. Given the slow moving nature of Ichimoku, a reversal of both Price & Momentum should be respected, and push our eyes to the lower right of the chart for anticipated price action. A break above the 100-DMA mentioned above would shift the bias to neutral until we obtain further clarity.

--- Written by Tyler Yell, CMT. Currency Analyst for DailyFX.com

To receive Tyler’s analysis directly via email, please SIGN UP HERE

Contact and follow Tyler on Twitter: @ForexYell