Talking Points:

- Gold prices probe below range support on swelling risk appetite

- Crude oil prices still stuck in consolidation mode above $44/bbl

- Comments BOE’s Weale may be formative for sentiment trends

Gold prices are under pressure as risk appetite swells at the start of the trading week. The chipper mood is weighing on bond prices, offering support to yields and undermining support for anti-fiat assets. Crude oil prices are diverging from the broader risk-on dynamics, with prices edging downward amid news that a military coup that broke in Turkey over the weekend has failed. The move seems to reflect easing worries about supply disruptions considering the country is a major transit area for supply from Russia and Iraq.

Looking ahead, speculation about the aftermath of the UK Brexit referendum is likely to return to the spotlight. Bank of England official Martin Weale is scheduled to speak about the vote’s implications for the trajectory of monetary policy. Rhetoric supporting the likelihood of stimulus expansion in August in line with hints offered in last week’s policy announcement is likely to prove supportive for risk appetite. This may see continued losses for gold. As for the WTI contract, it remains to be seen how quickly prices can shrug off overhang from geopolitical jitters.

Where are gold and crude oil prices heading in the third quarter? See our forecasts here !

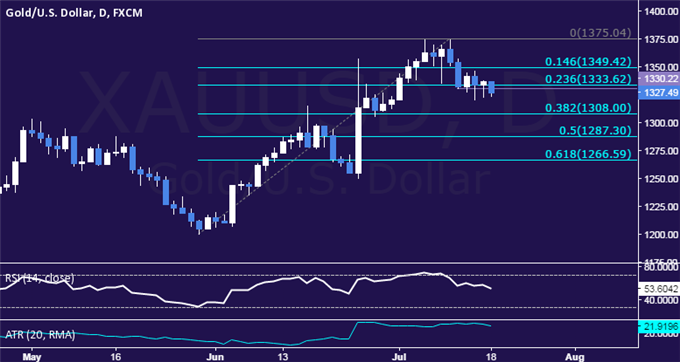

GOLD TECHNICAL ANALYSIS – Gold prices are testing below support in the 1330.22-32.17 area (July 12 low, 23.6% Fibonacci retracement) once again. A daily close below this threshold targets the 38.2% level at 1308.00. Alternatively, a move back above the 14.6% Fib at 1349.42 opens the door for a retest of the July 11 high at 1375.04.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices remain stuck in a range above the $44/bbl figure. A daily close above 48.14 (falling trend line, 14.6% Fibonacci expansion) exposes the 50.45-51.64 area (23.6% level, June 9 high). Alternatively, a move below the July 11 low at 44.40 targets the 38.2% Fib retracement at 41.86.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak