Australian Dollar, AUD/USD, Chinese Inflation, Iron Ore -Talking Points

- Wall Street falls to start the week as technology stocks lead losses

- Chinese inflation data is on tap amid a surge in iron ore prices

- AUD/USD slightly weaker after big push higher last week, where next?

Tuesday’s Asia-Pacific Outlook

Asia-Pacific markets may see a degree of downward pressure across currencies and equities following a downbeat Monday session on Wall Street. Technology stocks moved sharply lower, with the Nasdaq 100 index dropping 2.63% on the day. Small-cap stocks also saw heavy losses. After the close, the Food and Drug Administration (FDA) approved the Pfizer-BioNTech Covid shot for use in children ages 12 to 15. The move is seen as a boost to achieving herd immunity, and with that, a potential full economic reopening in the US.

Risk-sensitive currencies such as the Australian Dollar and New Zealand Dollar are holding gains from late last week, although now slightly lower against the Greenback. Bitcoin, Ethereum, and Dogecoin are all seeing deep losses, with BTC/USD flashing a bearish technical breakdown. The bearishness across major crypto assets comes after the much-hyped Elon Musk appearance on Saturday Night Live (SNL) over the weekend, although it appears to have turned into a “sell the news” event.

Surging commodity prices may have been responsible for some of the upward pressure on US Treasury yields overnight. The benchmark 10-year yield rose a full percentage point as investors ditched US government bonds. Higher raw material costs are seen as a strong inflationary pressure in markets, with commodities like iron ore and copper making significant gains to begin the week.

That said, rising iron prices bode well for the Aussie Dollar due to it being Australia’s largest export, with China driving much of the demand. That, along with the weak USD, has put AUD/USD above the 0.78 handle. Speaking of China, the economic powerhouse is set to report inflation data for April this morning. Analysts expect a print of 1.0% on a year-over-year basis, according to the DailyFX Economic Calendar. The Yuan is unlikely to react, but the figure will feed into the broader global narrative.

China will also see new Yuan loans data for April cross the wires later today, with analysts expecting a print of CNY1600 billion. That would figure will represent a decrease from the prior month, as the People’s Bank of China (PBOC) continues to normalize policy amid a strong economic recovery. Outside of China, the Philippines is set to announce its Q1 gross domestic product.

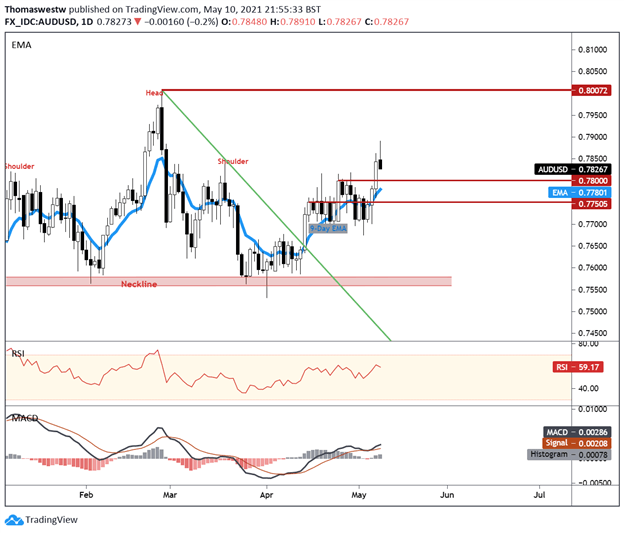

AUD/USD Technical Breakdown

The Australian Dollar put in a sharp rally versus the US Dollar last week, and prices are hovering near multi-month highs. Still, overnight weakness has AUD/USD surrendering a portion of last week’s gains, but support at the 0.78 handle is likely if the currency pair drops further. Moreover, MACD is increasing to the upside, indicating a potential strengthening in upward momentum.

AUD/USD Daily Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter