Wall Street, AUD/USD, AU Inflation, FOMC – Talking Points

- Wall Street trading moves lower as investors weigh stimulus odds

- APAC equity markets look ahead to the US Federal Reserve decision

- Australian Q4 inflation data may extend AUD/USD gains if data beats

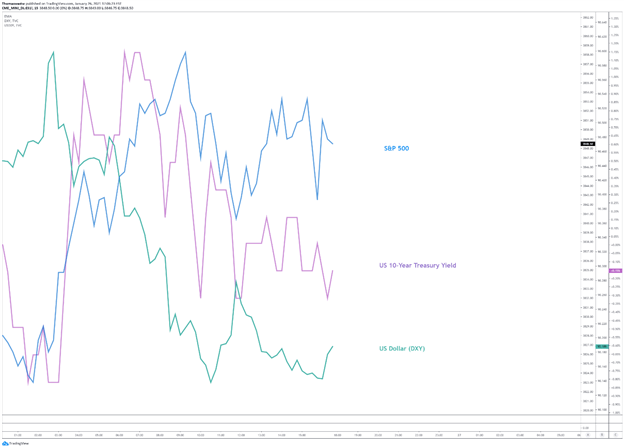

The S&P 500, Nasdaq Composite and Dow Jones Industrial Average gave up early gains on Tuesday and closed in the red by 0.15%, 0.07% and 0.07%, respectively. The Russell 2000 index led stocks lower, closing in the red by 0.62%. The drop in small-cap stocks may reflect growing fears over Covid-induced lockdowns in the US, despite this morning’s upbeat January consumer confidence figure from the Conference Board, released Tuesday morning.

The 10-year Treasury yield rose six basis points to 1.036%, following a sharp drop in US government bond yields on Monday. Concerns are swirling over the chances for more fiscal aid in the United States amid growing pushback from Republican lawmakers. Meanwhile, the White House announced it is stepping up its vaccination distribution efforts after announcing the US will purchase 200 million additional vaccine doses.

S&P 500, 10-Year Treasury Yield, US Dollar – Daily Chart

Chart created with TradingView

Wednesday’s Asia-Pacific Outlook:

Asia-Pacific markets may extend the risk-off tone seen in Tuesday’s Wall Street session as the same concerns over US fiscal stimulus weigh on investors’ minds. The upcoming Federal Reserve interest rate decision is another likely driver for Wednesday’s session. After weeks of gains in equity indexes and other risk assets, traders may take a cautious approach leading into the FOMC event.

While the Fed’s benchmark rates are expected to remain unchanged, economists and other market participants will be keying in on Chair Jerome Powell’s language over the economic recovery and the central bank’s balance sheet. Some expect an off chance for a rollback in asset purchases, but a “wait and see” outcome may be more likely, especially with prospects of additional fiscal stimulus following the recent changes across Capitol Hill.

Aussie-Dollar traders will be eyeing Australia’s Q4 inflation rate, which is expected to cross the wires at 00:30 GMT. The Australian Dollar is up nearly half a percent against the Greenback so far this week, and the upside may continue if inflation data impresses. According to the DailyFX Economic Calendar, the consensus forecast is 0.7% on a YoY basis.

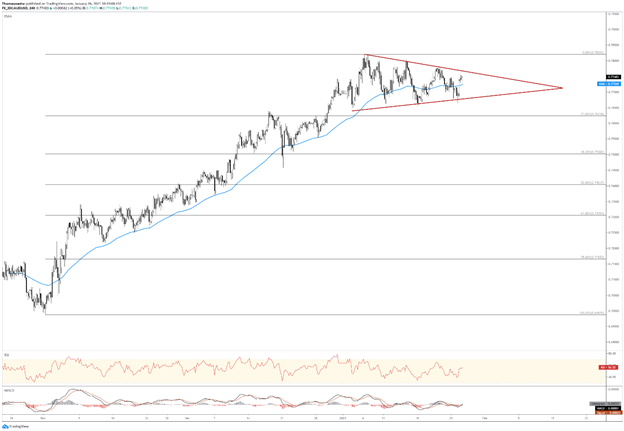

AUD/USD Technical Outlook

AUD/USD is approaching the upper bound of a Symmetrical Triangle after rising above its 12-day Exponential Moving Average earlier this week. The aforementioned inflation data will likely be a key driver for price action, but momentum appears primed to continue following a bullish MACD crossover. Moreover, the Relative Strength Index is improving within neutral territory.

AUD/USD 4-Hour Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter