Australian Dollar, AUD/USD, Retail Sales, US Stimulus – Talking Points

- US stimulus talks come to a conclusion as Congress begins voting on relief bill

- AUD/USD fails to show upside reaction to stellar local November retail sales data

- US Covid hospitalizations rise further, new UK strain adds to investors’ worries

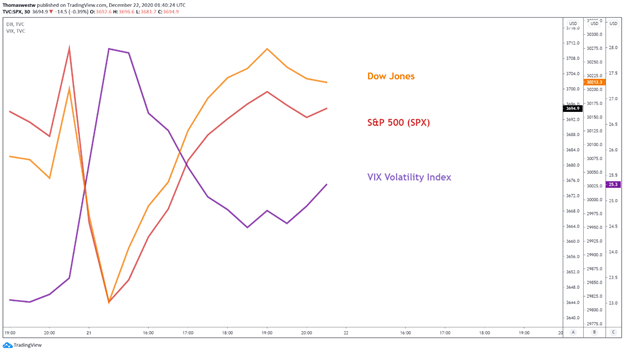

US lawmakers are in the final stages of approving a Covid aid bill that will inject $900 billion of relief funds into the economy through direct stimulus payments to Americans, supplemental unemployment benefits, Covid vaccine distribution measures, and other virus-related health measures. Progress on Capitol Hill wasn’t reflected on Wall Street, however, with the S&P 500 and Nasdaq Composite falling 0.39% and 0.11%, respectively.

The Dow Jones managed to close out the session with a slight gain however as financial stocks made solid progress following last week’s Fed bank stress test results that cleared the way for large lenders to begin issuing dividends in Q1 2020. Still, the VIX volatility index – investors’ so-called “fear gauge” – rose nearly 17% on Monday, and spiked over the 30 handle in intraday trading.

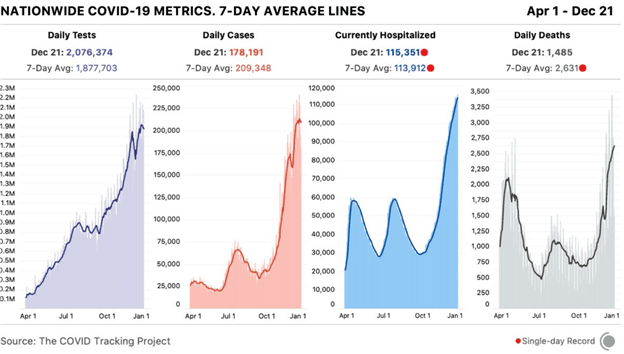

US Covid Statistics

Source: The Covid Tracking Project

The risk-off move appears to come as an increasingly worrisome Covid situation shifts into view for investors. US hospitalizations continue to rise with a record-breaking 115,351 currently hospitalized from Covid as of December 21, according to The Covid Tracking Project. New worries about the coronavirus in the UK also appear to have prompted the risk-off turn, with a recent mutation identified in the virus causing the country to impose a higher tier of lockdowns across London and new travel restrictions from other European countries.

S&P 500, Dow Jones, VIX Index– 30-Min Chart

Chart created with TradingView

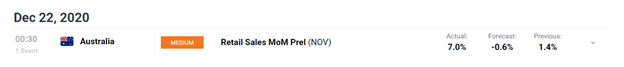

Tuesday’s Asia-pacific Outlook

The Asia Pacific session is seeing early signs of a risk-off spillover from Wall Street trade as Covid-19 worries look to keep investors on edge. The Australian Dollar also failed to benefit from a blowout beat on preliminary local retail sales data. According to the DailyFX Economic Calendar, receipts for November climbed 7.0% versus estimates calling for a 0.6% decrease. AUD/USD traded to the downside despite this stellar outcome.

Economic prints for the rest of the week appear relatively light across the Asia Pacific region. However, the United States and the United Kingdom are both set to release their final economic growth figures for the third quarter, with the UK expected to post a 15.5% Q3 growth rate, and the US a more impressive 33.1% reading. While both data prints constitute final readings for GDP, any deviation from analysts’ expectations may see a sizeable market reaction.

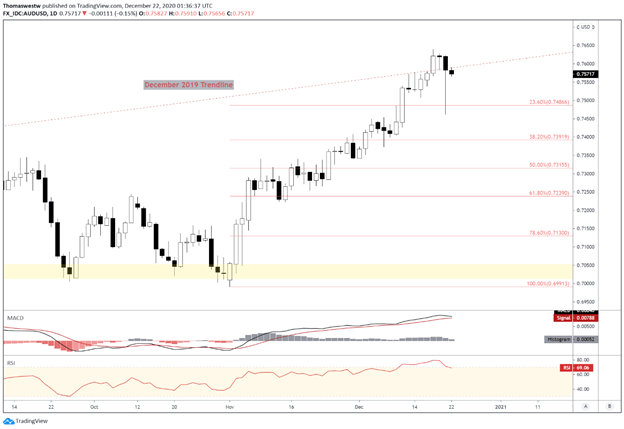

AUD/USD Technical Outlook:

After putting in fresh multi-year highs last week, AUD/USD has broken back below a 2019 trendline. The recent breakdown leaves the longer-term rally intact, but the downward pressure may likely signal a short term exhaustion for Aussie-dollar bulls. The 23.6% Fibonacci retracement level from the October swing low to the recent high was broken by a sharp intraday move lower. Prices have since recovered and now rest below the 2019 trendline.

The breakdown in momentum, despite November’s stellar retail sales, is reinforced by the technical structure in AUD/USD. The current MACD is converging, and RSI broke below the 70 overbought level. The 0.75 handle, which sits slightly above the 23.6% Fib retracement (0.7486) may serve as a point of contention on any further pushes lower. Should AUD/USD hold above that level, or the current higher levels, the longer-term bull trend may likely resume.

AUD/USD Daily Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter