US Dollar, British Pound, Euro, Brexit, Powell Testimony, South Korea Budget Proposal - Talking Points

- US Dollar could retreat on Powell and Mnuchin’s congressional testimonies

- British Pound outlook bearish on Brexit talks and rising tension with Europe

- EU summit may push Euro higher if officials agree on a coordinated strategy

US Dollar May Retreat on Mnuchin, Powell Testimonies

The US Dollar may retreat if congressional testimonies by Fed Chairman Jerome Powell and Treasury Secretary Steven Mnuchin further amplify selling pressure in the haven-linked Greenback. While there remain several significant risks to the economic outlook, modest signs of stabilization appear to be bolstering risk appetite and punishing demand for anti-risk assets.

You can read a more detailed analysis from my US Dollar weekly forecast here.

Both Powell and Mnuchin will likely stress the need for additional fiscal stimulus following unsuccessful negotiations between Republicans and Democrats. Bipartisan intransigence and a lack of additional stimulus could cause a mutation in the economic narrative from stabilization to regression. Growing pessimism may then catalyze financial volatility and put a premium on haven-linked assets like USD and the anti-risk JPY.

British Pound Braces for Brexit Talks, EU Tension

The British Pound will likely continue to be held hostage by ongoing Brexit negotiations ahead of a key deadline in the fall. Tension between the EU and UK recently escalated after Prime Minister Boris Johnson introduced the Internal Market Bill that overrides key provisions set in place by the original EU-UK Withdrawal Agreement; one of them being the Northern Ireland Protocol.

Without delving into too much detail, the bill’s main aim is to ensure the fluid movement of goods between the four nations of the United Kingdom. From a market-oriented perspective, the main takeaway is the overriding of some provisions in the original EU-UK agreement. The regulatory divergence between both the Withdrawal Agreement and the Internal Market Bill has strained what were already-fragile EU-UK relations.

South Korean Won May Rise on Bold Budget, Regional Stabilization

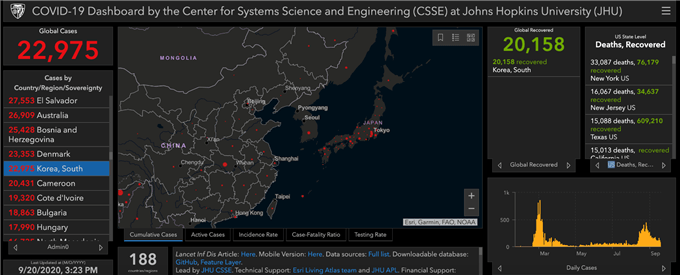

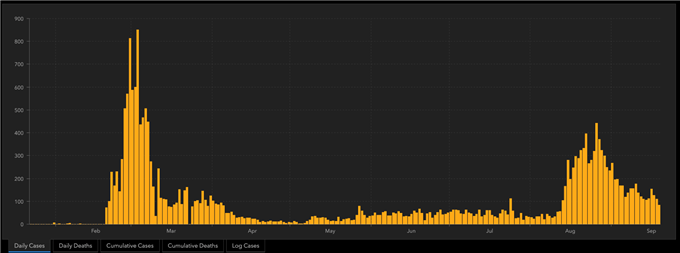

The South Korean Won may strengthen against its regional counterparts but particularly against the Japanese Yen and US Dollar if the South Korean parliament puts forward a bold supplementary budget. In late-August/early-September, coronavirus cases surged into triple-digit territory, making the case for easing lockdown measures that much more difficult.

The spike in cases comes as the region was beginning to experience – alongside most of the world – early signs of stabilization and general economic recuperation. Stronger growth prospects out of China – South Korea’s largest trading partner – helped buttress the latter’s recovery. However, resurgent cases threaten to derail what was looking like a sharp initial bounce after the collapse in March.

Coronavirus Cases: South Korea

Source: Johns Hopkins CSSE

South Korean legislators this week are preparing a $6.6 billion package to help small businesses that are struggling with shelter-in-place orders from the domestic flare up of Covid-19. President Moon Jae-in said that the surge in viral infections will likely dampen the recovery. Despite these dire circumstances, if policymakers come forward with a bold and coordinated fiscal plan, it could boost KRW.

Euro Eyes EU Summit

This week, EU lawmakers will be convening to discuss internal and external geopolitical concerns, ranging from Brexit to relations with China. Another topic of discussion will include industrial strategy and other aspects for ensuring a smooth economic recovery following the economic fallout. Signs of coordination and unity may help push the Euro higher, though intra-regional disputes may weigh on talks and hurt the Euro.

Having said that, while past performance is not indicative of future results, Europe has shown to come together and compromise when necessary. When policymakers were arguing over a EUR750b stimulus package, discussions were at a stalemate for several days before a deal was finally brokered. Following the resolution, the Euro surged with domestic bond yields and local equity markets.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter