Australian Dollar, New Zealand Dollar, AUD/NZD, Euro, Coronavirus – TALKING POINTS

- AUD, NZD, SEK were the champions during Wall Street trade along with stock markets

- European currencies were the biggest losers as cross-Atlantic tensions continue to rise

- AUD/NZD may capitulate for a fifth time below a five year descending resistance slope

Wall Street trade had a rocky start but ultimately ended on a happy note with the S&P 500 index closing 1.10 percent higher. The sector with the greatest gains within the benchmark was financials which was given a boost by news of regulatory rollbacks by the Federal Deposit Insurance Commission. One of them included making it easier for banks to direct large investments into funds like venture capital.

The other was not making it a requirement for banks “to set aside cash for derivatives traders between different affiliates of the same firm, potentially freeing up more capital”. This helped to shake off the pessimism from another higher-than-expected jobless claim figure at 1480k, far above the 1320k estimate. Having said that, concern about rising coronavirus cases in the US does continue to rattle already-fragile investor confidence.

EU-US geopolitical tensions over trade and now controversy over a Russian-European gas pipeline is stoking even more uncertainty at a time when the circumstances are unusually fluid. These factors together created a somewhat mixed picture for FX markets. The Euro, Swiss Franc and Danish Krone were the session’s biggest losers while the cycle-sensitive Swedish Krona, Australian and New Zealand Dollars were the winners.

Friday’s Asia-Pacific Trading Session

With a relatively sparse data docket, traders will likely orient their focus on macro-fundamental themes, with the growing number of coronavirus cases in the US as the focal point. Uncertainty there could curb AUD and NZD’s enthusiasm, though improving Asian growth prospects and moderate signs of stabilization in China – despite another Covid-19 flare up in Xinfadi – could give a tailwind to commodity-linked currencies.

AUD/NZD Technical Analysis

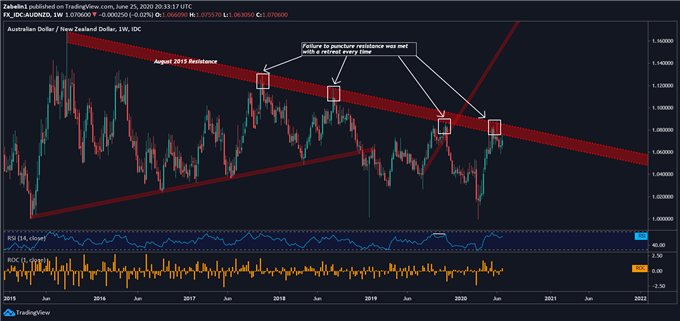

AUD/NZD may be in the final throes of a desperate attempt to clear a five-year descending resistance channel after failing to breach four times. Capitulation could broadcast a signal of doubt in the pair’s upside potential in the medium term. Consequently, this bearish outlook could inspire sellers to flood the market and cause the pair to retreat.

While past performance is not indicative of future results, AUD/NZD has on average declined six percent after every rejection at the slope of depreciation. To get more technical updates, be sure to follow me on Twitter @ZabelinDimitri.

AUD/NZD – Weekly Chart

AUD/UZD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter