Canadian Dollar, USD/CAD, Crude Oil, Dow Jones, Financial Stocks – Asia Pacific Market Open

- The Canadian Dollar gained with crude oil prices as Dow Jones climbed

- Financial stocks rose, mortgage giants extended foreclosure suspensions

- Asia Pacific stocks may rise, boosting the Australian Dollar as Yen falls

Canadian Dollar, Crude Oil, Dow Jones Gain as Financials Lead Stocks Higher

The growth-linked Canadian Dollar – which can at times be sensitive to crude oil prices – cautiously rose Thursday as sentiment recovered during the North American trading session. WTI crude oil closed at its highest since early April as the Dow Jones and S&P 500 wrapped up +1.62% and +1.15% at the end of the session. This followed earlier declines in equivalent futures contracts during Asia Pacific hours.

Financials lead the way in stocks. Reports crossed the wires that Fannie Mae and Freddie Mac - two mortgage giants - extended suspension of foreclosures and evictions until June 20. These measures were taken as the coronavirus outbreak and subsequent lockdown laws dented economic health. Mark Calabria – the Federal Housing Finance Agency Director – said that “no one should be forced from their home” during the crisis.

Sentiment then improved later in the session as Connecticut corrected jobless claims down to 29,846 from 298,680. This was after nationwide jobless claims surged over 2.9 million last week. The revision likely poured cold water on the initial report missing the 2.5m consensus. Meanwhile House Speaker Nancy Pelosi left the door open for negotiations to pass a virus bill. This is as the White House threatened to veto the bill Democratic policymakers proposed this week.

Discover your trading personality to help find forms of analyzing financial markets

Friday’s Asia Pacific Trading Session

With that in mind, we may see Asia Pacific equities follow the optimistic lead from Wall Street as the week wraps up. That may extend some of the slight gains from the sentiment-linked Australian Dollar over the past 24 hours. This may also bode ill for the anti-risk Japanese Yen. AUD/USD may also be closely watching incoming Chinese industrial production and retail sales data. These will offer further insight into the health of the world’s second-largest economy.

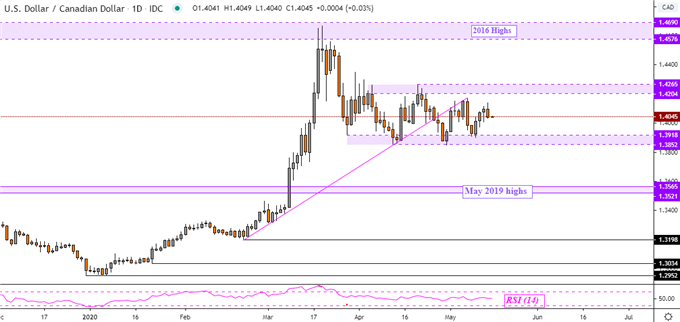

Canadian Dollar Technical Analysis

Despite recent gains in the Canadian Dollar, USD/CAD remains in a persistent consolidative mode. Prices have been ranging between 1.3852 and 1.4265 since late March. The direction of the breakout may pave the way for the pair’s next trend given technical confirmation. The break under rising support from late February – pink line below - has struggled to achieve confirmation.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

USD/CAD Technical Analysis – Daily Chart

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter