Canadian Dollar, USD/CAD, Crude Oil, AUD/USD, Wall Street – Asia Pacific Market Open

- Canadian Dollar sank with crude oil prices despite rally on Wall Street

- Health care securities helped drive the “risk-on” tone, Yen still climbed

- USD/CAD bounced but key resistance maintains the downward outlook

Canadian Dollar Sinks with Crude Oil Prices Despite Stock Market Rally on Wall Street

The Canadian Dollar was one of the worst-performing major currencies to start the week, depreciating alongside crude oil prices. WTI declined -7.27% to an 18-year low amid ongoing bearish fundamental themes, the coronavirus outbreak and a global supply glut. The commodity is a key source of revenue in Canada, making the Loonie often sensitive to swings in oil depending on the latter’s impact on monetary policy bets.

Sentiment-linked WTI was unable to capitalize on a “risk-on” tilt in equities towards the end of the day. The S&P 500 closed 3.35% to the upside, fueled by outperformance in health care securities. This is despite US President Donald Trump announcing an extension of virus guidelines until the end of April, backing down on hopes of starting to open the economy by the Easter holiday in about 2 weeks.

The latter may have been what ignited to a “risk-off” tilt in Asia trade that boosted the haven-linked US Dollar and similarly-behaving Japanese Yen. Prior to Wall Street open Johnson & Johnson – a US medical device company – announced a lead vaccine candidate for COVID-19. Then another local medical firm - Abbott Labs - unveiled a 5-minute test kit for the coronavirus. Both companies’ shares surged, helping the “risk-on” tilt.

Sentiment-linked oil prices were unable to capitalize on the rosy North American trading session. A price war between key producers Saudi Arabia and Russia has been adding downside pressure to crude as world travels grinds to a halt. This resulted in a call today between Presidents Donald Trump and Vladimir Putin. Both discussed efforts to combat COVID-19. They also agreed on the importance of stability in energy markets.

Tuesday’s Asia Pacific Trading Session – AUD/USD, China PMI

With that in mind, Asia Pacific equities may follow the upbeat Wall Street session. That may benefit the growth-linked Australian Dollar while sapping the appeal of the Yen. AUD/USD will be closely watching official Chinese PMI data for March which will cross the wires at 1:00 GMT.

Coronavirus cases in the word’s second-largest economy appeared to have stabilized for the same period the surveys will cover. A rosy outcome could propel the Aussie higher in the near term. After all, China is Australia’s largest trading partner. Follow-through may have to wait until equities digest the news later on.

Canadian Dollar Technical Analysis

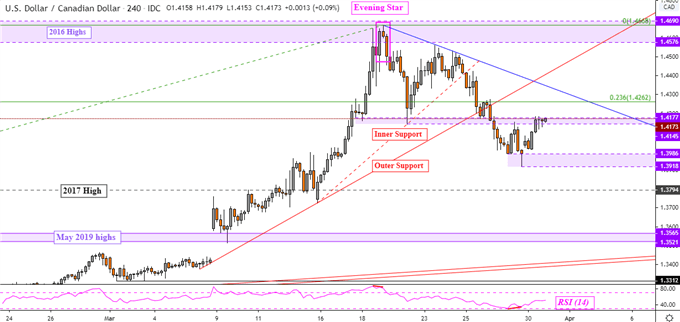

The USD/CAD medium-term trajectory still appears to favor the downside after the pair took out “outer” support on the 4-hour chart below. Prices have bounced after forming support which is a range between 1.3918 to 1.3986. Overturning the downside bias entails taking out falling resistance from this month’s peak just under 1.4890 – blue line. A close above 1.4177 may send USD/CAD targeting that resistance line.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

USD/CAD 4-Hour Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter